We’re proud to share that Investopedia has named Sharesight the Greatest Portfolio Tracker for DIY Buyers in its 2025 ‘Best Portfolio Management Software Tools‘ overview.

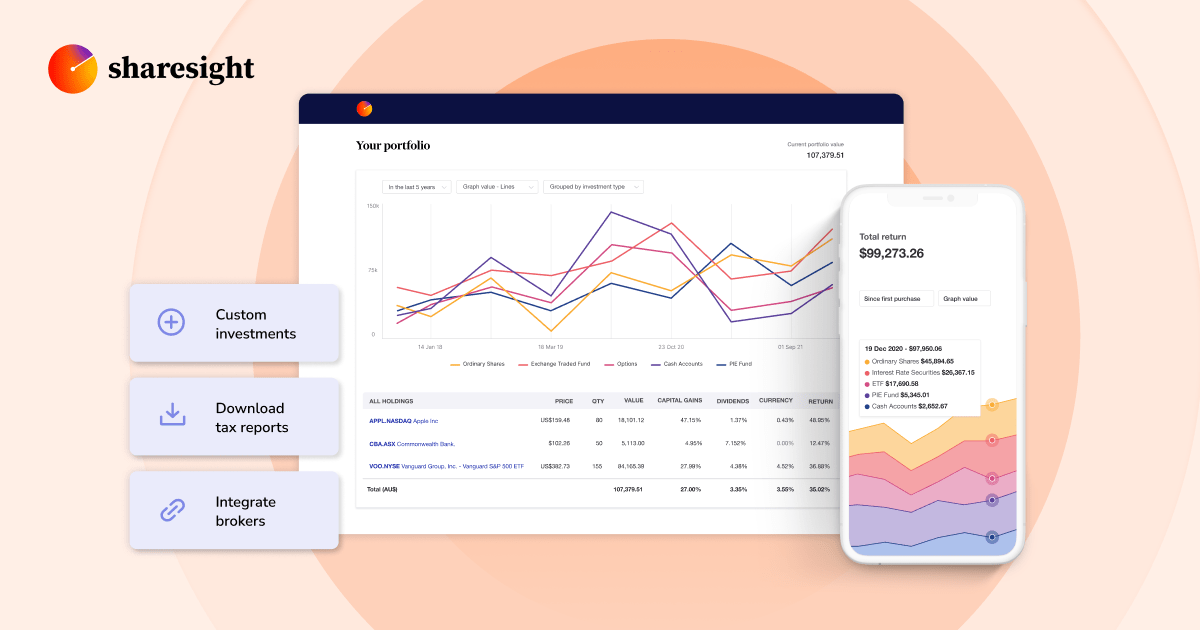

This recognition reaffirms what our customers already know — managing investments shouldn’t require a finance diploma or pricey advisory providers. As DIY investing grows globally, extra people are taking management of their monetary futures, but monitoring efficiency, tax implications, and portfolio well being throughout a number of platforms stays a problem that spreadsheets merely can’t tackle effectively. Sharesight fills this hole by providing professional-grade portfolio insights in an intuitive platform constructed particularly for particular person traders.

![]()

Investopedia’s analysis course of

Of their complete analysis, Investopedia’s analysis workforce analysed 10 main portfolio administration platforms throughout 576 various factors, starting from reporting capabilities to consumer expertise. Their verdict? Sharesight is “the only option for do-it-yourself (DIY) traders due to its easy-to-use and well-thought-out platform, designed particularly to assist retail traders transfer past spreadsheets when monitoring their portfolios”.

Among the many strengths highlighted in Investopedia’s evaluation:

- International monitoring capabilities for shares and mutual funds

- Help for worldwide accounts and holdings

- Portfolio benchmarking options

- Versatile pricing tiers appropriate for everybody from learners to superior traders.

International monitoring for a world market

One of many key strengths highlighted in Investopedia’s overview is our world monitoring functionality. In as we speak’s interconnected markets, traders are more and more diversifying throughout worldwide exchanges and asset lessons. Sharesight’s skill to trace investments throughout a number of markets and currencies provides DIY traders a real image of their portfolio’s efficiency — one thing that was beforehand accessible solely to skilled cash managers.

Whether or not you are monitoring investments on the ASX, LSE or US exchanges (and extra), cryptocurrencies and even property, Sharesight supplies a single dashboard that robotically handles forex conversions and efficiency calculations.

Past primary efficiency monitoring

Whereas many platforms supply primary efficiency metrics, Sharesight stands aside by offering deeper insights that matter to severe traders:

- True annualised efficiency calculations that account for the timing of money flows

- Dividend monitoring together with upcoming dividend funds

- Danger reporting tailor-made to your particular investments

- Contribution evaluation to establish which investments are driving your returns

- Customized benchmarking to measure efficiency in opposition to related indices.

These options are why half 1,000,000 DIY traders have moved past spreadsheets and primary brokerage statements to achieve higher visibility into their funding efficiency.

Our dedication to DIY traders

Since our founding, Sharesight has been constructed particularly for particular person traders who need professional-quality portfolio monitoring with out the complexity and value of enterprise options. This recognition from Investopedia reinforces our dedication to persevering with alongside this path.

“Being named as the only option for DIY traders by Investopedia is especially significant as a result of it aligns completely with our mission,” says Doug Morris, Sharesight CEO.

“We have at all times targeted on empowering particular person traders with the instruments they should make knowledgeable choices, and we’ll proceed enhancing our platform primarily based on their suggestions.”

Wanting ahead

As DIY investing continues to evolve, so will Sharesight. We’re repeatedly engaged on new options and enhancements primarily based on consumer suggestions and altering market situations. The funding panorama could also be advanced, however monitoring your portfolio would not must be.

Whether or not you are simply beginning your funding journey or managing a classy portfolio throughout a number of asset lessons, we’re honored that Investopedia has recognised Sharesight as the most effective answer for DIY traders.

Change into a savvy investor with Sharesight

Be part of over 500,000 traders worldwide utilizing Sharesight to get deeper insights into their portfolio and make knowledgeable investing choices. With Sharesight you may:

- Monitor all of your investments in a single place, together with shares in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

- Robotically monitor your dividend and distribution income from shares, ETFs and mutual/managed funds

- Run highly effective experiences constructed for traders, together with performance, portfolio diversity, contribution analysis, exposure, multi-period, multi-currency valuation, risk and future income (upcoming dividends)

- Simply share access of your portfolio with relations, your accountant or different monetary professionals to allow them to see the identical image of your investments as you do

Sign up for a FREE Sharesight account and get began monitoring your funding efficiency (and tax) as we speak.

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)