As of April 2025, Morningstar has retired its portfolio tracking tool, Morningstar Portfolio Supervisor, together with its portfolio X-ray device. On this article, we’ll evaluate Morningstar Portfolio Supervisor to Sharesight, together with an in depth breakdown of the comparable options between the 2 portfolio trackers. We may also clarify how one can robotically export your Portfolio Supervisor information to Sharesight, and why Sharesight is one of the best portfolio tracker for UK buyers.

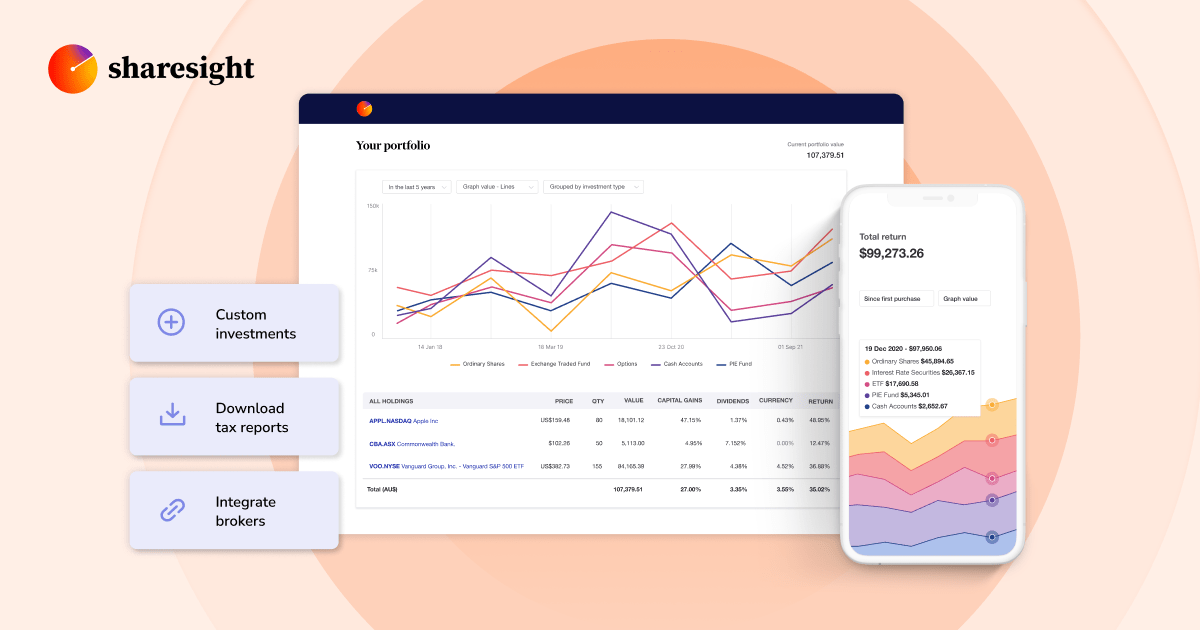

Designed for self-directed buyers, Sharesight is a complete on-line portfolio monitoring device that robotically tracks the efficiency of your investments – eliminating the necessity for Excel spreadsheets. In contrast to the information supplied by most brokers, Sharesight considers the impression of capital positive factors, dividends, brokerage charges and foreign money fluctuations when calculating returns, supplying you with the entire image of your efficiency. Sharesight additionally affords a variety of highly effective reporting instruments designed to provide you deep perception into your efficiency, asset allocation, diversification, danger profile, tax planning and extra – permitting you to make knowledgeable selections about your portfolio.

| Function | Morningstar Portfolio Supervisor & X-ray device | Sharesight’s portfolio tracker |

| Asset help |

Shares, ETFs, unit trusts/OEICs, pension funds |

Shares, ETFs, managed/mutual funds, cryptocurrency, property, different unlisted investments similar to artwork, boats, and so on. |

| Automated dealer help |

Restricted, if any, direct dealer feeds |

Intensive automation with many fashionable UK brokers, together with Interactive Investor, Buying and selling 212, Interactive Brokers and extra |

| Company actions |

Fundamental dealing with |

Automated dealing with of many company actions (dividends, DRPs, splits, and so on.) |

| Portfolio x-ray / diversification instruments |

Portfolio X-ray provided an in depth look-through of funds/ETFs (underlying holdings, asset allocation, sector, geographic publicity, inventory fashion). It recognized any overlaps |

Exposure report: Shows ETF and fund underlying holdings, serving to buyers establish portfolio overlap Diversity report: Offers an in depth breakdown of a portfolio’s asset allocation by nation, sector, business, market and customized groupings |

| Draw back danger / Drawdown evaluation |

The X-ray device helped buyers perceive danger by way of issue exposures (e.g., worth/development fashion) and focus. Efficiency historical past would present drawdowns |

The drawdown risk report offers a helpful metric to visualise the ratio of efficiency returns and max drawdowns in an funding by way of a metric referred to as RoMaD (Return over Most Drawdown) |

| Benchmarking |

Sure, might evaluate portfolio efficiency in opposition to normal benchmarks |

Sure, permits comparability in opposition to a variety of market benchmarks and ETFs (over 750,000 devices) |

| Efficiency monitoring |

Tracked total portfolio and particular person holding efficiency |

Detailed efficiency reporting (easy and compound strategies), exhibits capital positive factors, dividends, foreign money impression, brokerage charges |

| Revenue reporting |

Tracked dividends |

Taxable income report: Particulars all earnings occasions (dividends, distributions, curiosity) with related dates and quantities for the UK tax 12 months |

| CGT reporting |

Restricted particular CGT reporting. Knowledge was exportable for handbook calculation |

No devoted UK CGT report that robotically applies all HMRC guidelines (e.g., mattress and breakfasting, identical day rule). Presents a sold securities report which calculates positive factors on gross sales (sometimes utilizing a median price foundation). This report offers uncooked information that then requires handbook adjustment or accountant overview for UK CGT compliance |

| Dealing with ISAs/SIPPs |

Might be tracked as separate portfolios, however no particular tax remedy logic for these wrappers throughout the device itself |

Will be arrange as separate portfolios. Revenue/positive factors are calculated, however UK customers would manually disregard CGT implications for these wrappers as they’re tax-exempt |

| Knowledge exports |

Premium members might export to Excel. Morningstar said information export can be out there from July 2025 |

Complete export choices for all studies (Excel, PDF, Google Drive). Trades will also be exported |

| Value |

A part of free and Premium Morningstar memberships (Premium provided extra options like X-ray and information export) |

Freemium model: Free plan (restricted to 1 portfolio, 10 holdings). Paid plans unlock extra portfolios, limitless holdings, superior studies and precedence help |

| Analysis and scores |

Portfolio Supervisor built-in with Morningstar’s intensive fund/inventory analysis, analyst studies and scores |

Not a major characteristic. Sharesight focuses on monitoring and reporting your investments, not offering analysis or suggestions |

Key advantages of monitoring your portfolio with Sharesight

Whereas there are some variations between Sharesight and Morningstar Portfolio Supervisor, Sharesight is one of the best various for UK buyers looking for a complete portfolio administration resolution. Not solely does Sharesight largely fill the hole that Portfolio Supervisor leaves behind, it additionally affords a variety of superior options that transcend what was beforehand out there with the Morningstar resolution.

Increasing a little bit on the comparability desk above, listed here are a number of of the areas by which Sharesight affords advantages past Morningstar Portfolio Supervisor:

Extra intensive asset help

Whereas Morningstar Portfolio Supervisor supported core asset courses similar to shares, ETFs, unit trusts/OEICs and pension funds, Sharesight affords monitoring for a greater variety of property. Along with shares and ETFs, Sharesight helps managed and mutual funds, cryptocurrency, property, and even unlisted investments similar to artwork. This flexibility lets you monitor all your investments in a single place.

Computerized commerce information syncing

Morningstar Portfolio Supervisor provided restricted, if any, automated dealer feeds. In distinction, Sharesight automates commerce information syncing from over 200 world brokers, together with a variety of main UK brokers. This automation means trades are imported and up to date seamlessly, saving time and decreasing the danger of handbook information entry errors.

Portfolio evaluation instruments

One among Morningstar’s most valued options was the Portfolio X-Ray device, which supplied deep insights into asset allocation, geographic and sector publicity, in addition to fund look-throughs. Sharesight affords related (and in some instances extra customisable) instruments. For instance, the exposure report reveals the underlying holdings of ETFs and managed funds, permitting buyers to identify overlaps and assess the portfolio’s publicity to completely different markets, sectors and extra. Sharesight’s diversity report additionally offers buyers with a breakdown of their portfolio’s asset allocation by nation, sector, business, market and even customized groupings. Collectively, these instruments assist buyers perceive their portfolio’s composition and focus dangers at a look.

Detailed earnings reporting

For buyers who depend on earnings or want correct information for HMRC self-assessment, Sharesight’s taxable income report is crucial. It tracks all earnings occasions—together with dividends, distributions and curiosity funds—clearly outlining the quantities and related dates throughout the UK tax 12 months. This degree of element helps simplify buyers’ earnings monitoring and tax preparation. The future income report is one other great tool for dividend buyers to mission their cashflow by getting a view of upcoming introduced dividends. It additionally provides buyers the choice to overview their dividend earnings over the previous 12 months and even for the reason that inception of the portfolio.

True efficiency monitoring

Going past primary efficiency summaries, Sharesight delivers detailed and clear efficiency reporting. Traders can view each easy and compound returns for his or her total portfolio and particular person holdings, factoring in capital positive factors, dividends, foreign money fluctuations and brokerage charges. This strategy ensures buyers perceive the true drivers of their portfolio’s efficiency over time.

Methods to import your Morningstar Portfolio Supervisor information to Sharesight

In the event you’ve been monitoring your portfolio with Morningstar Portfolio Supervisor, it’s simple to get your buying and selling information into Sharesight.

Step one is to log into your Morningstar account and navigate to your buying and selling account to search out the hyperlink to obtain your trades.

Then if you happen to haven’t already, sign up for a free Sharesight account and create a brand new portfolio.

When you’ve began a brand new portfolio, you may be prompted to import your trades utilizing one in all three strategies. Merely choose ‘Seek for your dealer’ and sort ‘Morningstar’ into the search bar. After clicking on the dealer tile, you’ll have the choice to add the spreadsheet of trades you downloaded from Morningstar. Sharesight will then populate your portfolio with all of your buying and selling information, inclusive of dividends and distributions.

You possibly can import your Morningstar Portfolio Supervisor information to Sharesight in just some fast steps.

Observe your efficiency and tax with Sharesight

See why UK buyers are switching from Morningstar Portfolio Supervisor to Sharesight — sign up for a free account to start out monitoring your efficiency, tax, diversification and extra.

FURTHER READING

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)