Welcome to the FY24/25 version of our Australian buying and selling snapshot, the place we dive into this monetary yr’s prime trades by Sharesight customers. Beneath we are going to have a look at the highest trades general, plus the highest trades in particular person shares. This permits us to look at the broader funding developments by Australian Sharesight customers, whereas additionally giving us a possibility to zoom into the most well-liked shares and the market-moving information behind them.

High trades by Australian traders in FY24/25

Notice: To get a more in-depth have a look at this chart, you possibly can right-click and open the picture in a brand new tab (for desktop) or press-hold and obtain the picture or open it in an online browser (for cell).

In FY24/25, the highest commerce was Vanguard’s MSCI Index Worldwide Shares ETF (ASX: VGS), adopted by Vanguard’s Australian Shares Index ETF (ASX: VAS) and iShares’ S&P 500 ETF (ASX: IVV).

It needs to be famous that the property in our buying and selling snapshots are ordered by the variety of Sharesight customers buying and selling that asset, whereas the dimensions of the bars point out the precise commerce quantity. So whereas there are extra clients buying and selling in VAS, the amount of IVV trades is greater, that means that whereas there are fewer folks buying and selling in IVV in comparison with VAS, they’re making extra trades.

Total, it was a powerful yr for ETF buying and selling, with 11 of the highest 20 trades consisting of ETFs.

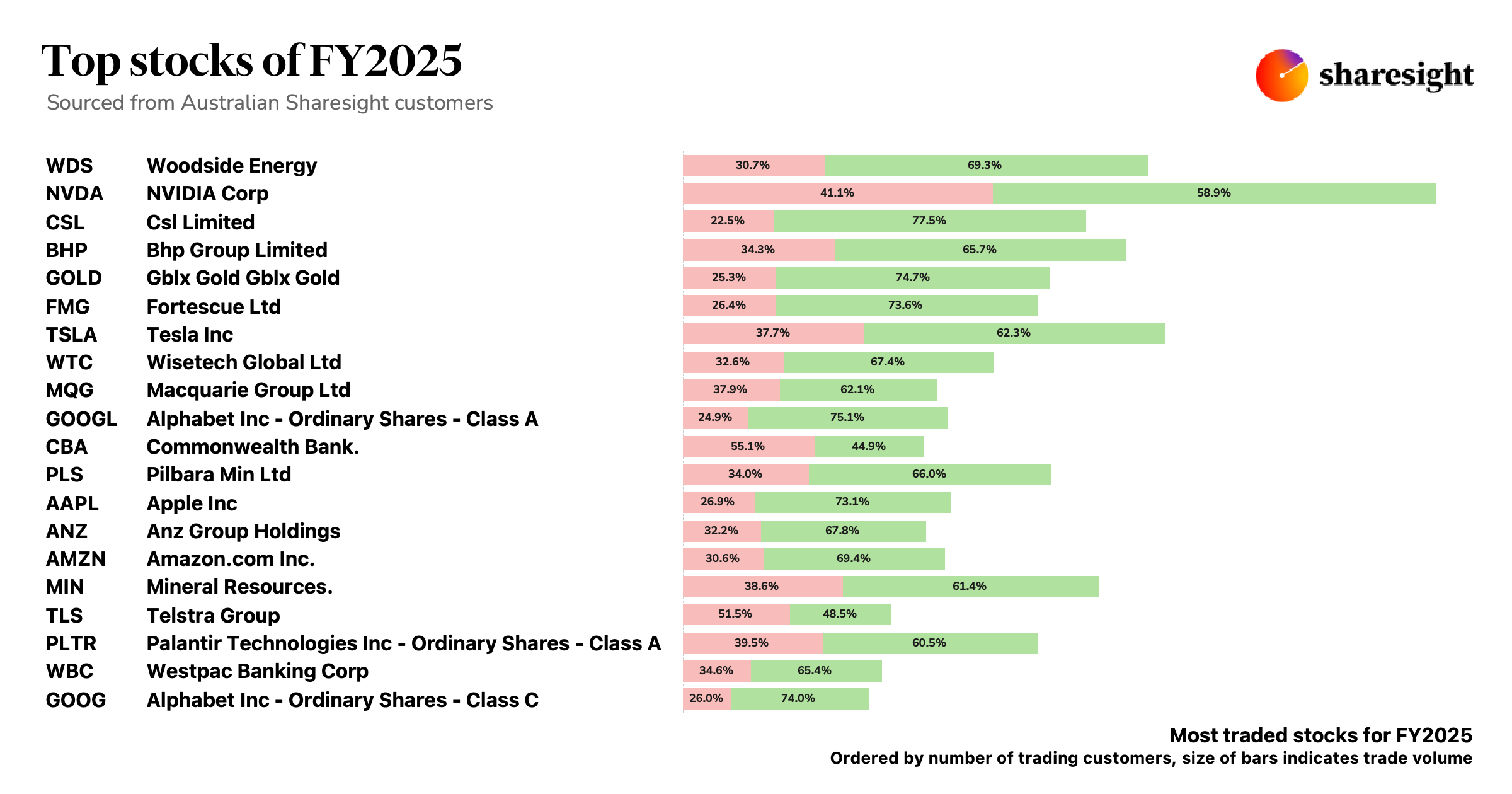

Most-traded shares by Australian traders in FY24/25

Notice: To get a more in-depth have a look at this chart, you possibly can right-click and open the picture in a brand new tab (for desktop) or press-hold and obtain the picture or open it in an online browser (for cell).

Woodside Power (ASX: WDS)

NVIDIA (NASDAQ: NVDA)

CSL (ASX: CSL)

BHP (ASX: BHP)

Gold

- October 2024: Gold worth hits new high; RBA says markets have been ‘spectacularly optimistic’

- November 2024: Gold price spikes in November as Russia-Ukraine battle escalates

- March 2025: Gold price is up 39% YoY

- April 2025: Consultants predict additional price rises when Trump’s 90-day tariff pause ends

- Might 2025: Billions of {dollars} able to be invested in gold explorers and builders

Fortescue Metals (ASX: FMG)

Tesla (NASDAQ: TSLA)

- September 2024: Tesla share worth hits 2-month high with Q3 outcomes and robotaxi occasion quickly to come back

- October 2024: Tesla beats Q3 earnings expectations, pushed by price cuts

- November 2024: CEO’s web price hits record high as share worth soars post-Election

- December 2024: Tesla CEO Elon Musk turns into first individual to succeed in US$400 billion net worth

- January 2025: Quarterly earnings miss expectations, with adjusted web earnings plummeting by 23%

- February 2025: Protests erupt throughout the US in “Tesla takedown” motion

- March 2025: CEO tells workers to carry onto their shares amid massive selloff, predicts ‘brilliant’ future regardless of backlash

- April 2025: Tesla reveals 71% revenue drop in quarterly earnings report, fuelled by adverse sentiment round Elon Musk

- Might 2025: Tesla share price hits highest degree since February

- July 2025: Share worth sinks as Musk-Trump feud continues

WiseTech International (ASX: WTC)

- August 2024: WiseTech beats FY24 expectations

- February 2025: WiseTech suffers mass board exodus over disagreement on controversial founder’s ongoing position; loses billions in market worth in a single day

- March 2025: Share worth down 28% in a month following board shakeup

- Might 2025: WiseTech acquires e2open for AU$3.2 billion

Monitor your funding portfolio with Sharesight

Get entry to insights like this by monitoring your funding portfolio with Sharesight. Constructed for the wants of traders such as you, with Sharesight you possibly can:

- Monitor all of your investments in a single place, together with shares, mutual/managed funds, property, and even cryptocurrency

- Get the true image of your funding efficiency, together with the affect of brokerage charges, dividends, and capital good points with Sharesight’s annualised performance calculation methodology

- Run highly effective stories constructed for traders, together with performance, portfolio diversity, contribution analysis, exposure, drawdown risk, multi-period, multi-currency valuation and future income

- Run tax stories together with taxable income (dividends/distributions), Capital Positive factors Tax (Australia and Canada), Traders Tax (Capital Positive factors for merchants in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a free Sharesight account and get began monitoring your investments right this moment.

Disclaimer: The above article is for informational functions solely and doesn’t represent a selected product advice, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use cheap endeavours to maintain the knowledge up-to-date, we make no illustration that any data is correct or up-to-date. When you select to utilize the content material on this article, you accomplish that at your personal threat. To the extent permitted by legislation, we don’t assume any duty or legal responsibility arising from or related along with your use or reliance on the content material on our website. Please examine along with your adviser or accountant to acquire the proper recommendation on your scenario.

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)