Disclaimer: The beneath article is for informational functions solely and doesn’t represent a selected product advice, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use cheap endeavours to maintain the knowledge up-to-date, we make no illustration that any data is correct or up-to-date. For those who select to utilize the content material on this article, you achieve this at your personal danger. To the extent permitted by regulation, we don’t assume any accountability or legal responsibility arising from or linked together with your use or reliance on the content material on our web site. Please examine together with your adviser or accountant to acquire the proper recommendation in your state of affairs.

Tax loss promoting is a technique which you could leverage to minimise your web capital positive factors earned over the monetary yr and cut back your revenue tax. Whereas tax loss promoting can be utilized at any time, it’s most helpful within the lead-up to the top of the monetary yr, when you may have a clearer image of your general capital positive factors or losses. This makes the ultimate months of the monetary yr an excellent time to evaluate your funding portfolio and resolve whether or not you may gain advantage from utilizing this technique to assist offset your capital positive factors.

This text will cowl:

What’s tax loss promoting?

Tax loss promoting (or tax loss harvesting) includes promoting investments which have incurred capital losses with a purpose to “web out” or offset capital positive factors realised through the yr. Basically, in case you want to promote out of sure unprofitable investments in your portfolio, chances are you’ll select to make use of tax loss promoting as a strategy to alleviate a few of that loss and re-align your portfolio together with your investing technique, even when the online impact continues to be adverse.

Whereas many buyers select to leverage tax loss promoting in direction of the top of the monetary yr, you may harvest losses at any time. The sum of money you save in taxes will differ relying in your tax price (particular person/belief, SMSF, firm), however it must be famous that larger tax rates will apply for investments you’ve held for lower than a yr (short-term capital positive factors) than investments you’ve offered after holding them for greater than a yr.

How does tax loss promoting work?

To assist clarify how tax loss promoting works, let’s have a look at an instance calculation:

Let’s say you acquire 500 shares of Inventory A just a few years in the past, when the worth was $30. Right this moment, it’s buying and selling at $300, that means its worth has elevated by $135,000. Sooner or later, you additionally purchased 500 shares of Inventory B when the worth was $100. Since then, the share worth has gone right down to $50, reducing its worth by $25,000.

| Holding | Buy Worth | Market Worth | Capital Achieve |

|---|---|---|---|

| Inventory A | $15,000 | $150,000 | $135,000 |

| Inventory B | $50,000 | -$25,000 | -$25,000 |

Whilst you may maintain onto Inventory B within the hope that its share worth will recuperate, you may additionally promote each Inventory A and Inventory B earlier than the top of the monetary yr to offset a number of the positive factors out of your sale of Inventory A together with your sale of Inventory B. Doing so might not solely soften the affect of the loss, however it is also a great alternative to shed an unprofitable inventory and rebalance your funding portfolio.

How you can mannequin tax loss promoting alternatives with Sharesight

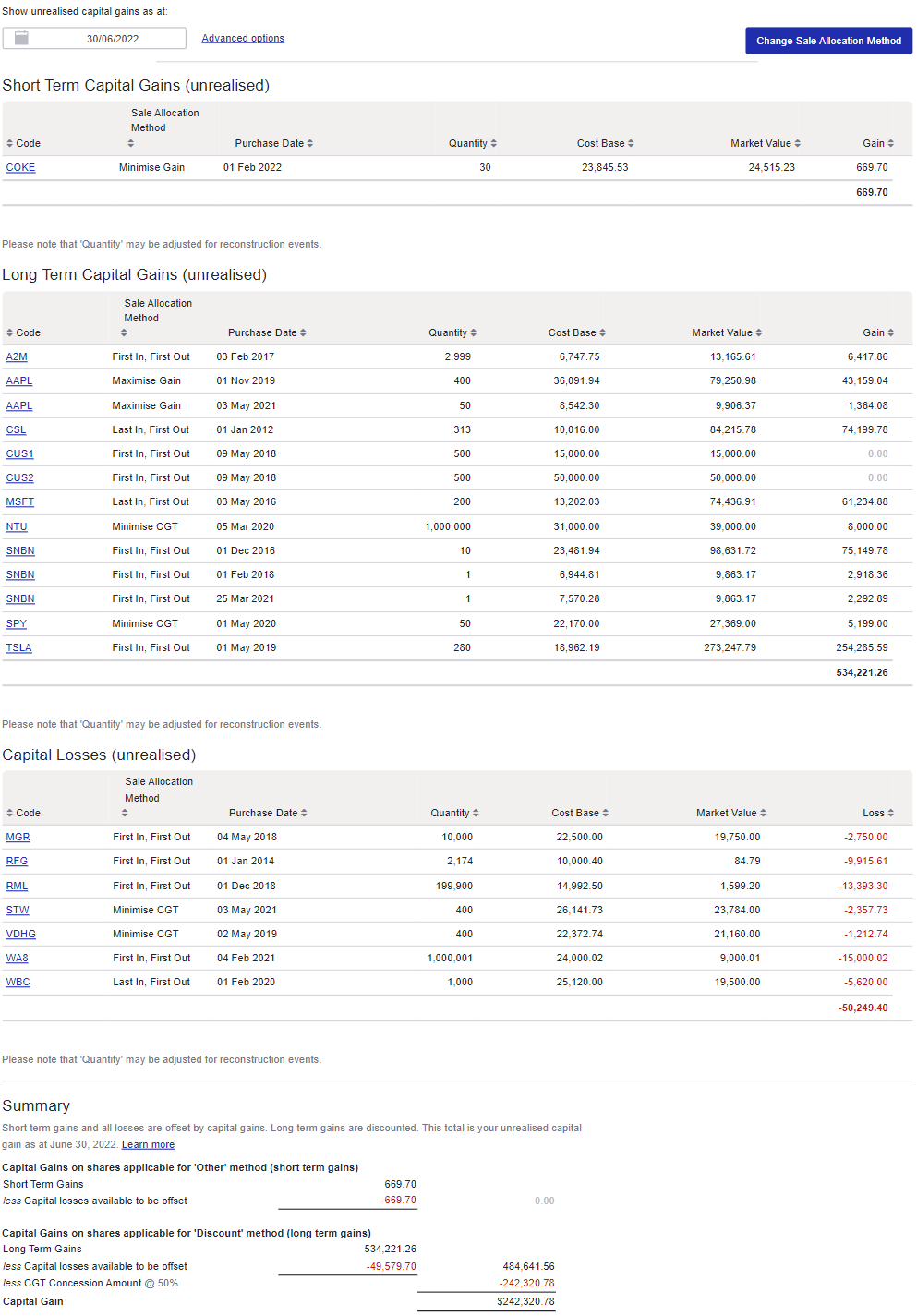

For those who maintain investments which have suffered losses this yr, Sharesight’s unrealised CGT report may also help you calculate the way to offset your capital positive factors by:

- Displaying the CGT place for all of your present holdings, in case you had been to promote them on the date of the report. These are damaged down into:

- Brief time period capital positive factors (unrealised)

- Long run capital positive factors (unrealised)

- Capital losses (unrealised)

- Modelling the CGT that might happen throughout your portfolio if the shares recognized had been offered on the report date.

- Permitting you to switch the CGT sale allocation technique on the general portfolio or particular person holding degree to find out your optimum place.

Sharesight’s unrealised CGT report makes it simple to mannequin completely different tax loss promoting eventualities.

The report makes use of the ‘discount method’ for shares which were held for a couple of yr and the ‘different technique’ for shares held for lower than one yr. The low cost price relies on the tax settings of an Australian portfolio:

- People / Belief – CGT low cost of fifty %

- Self Managed Tremendous Fund – CGT low cost of 33⅓ %

- Firm – CGT low cost of nil.

The report additionally means that you can specify the sale allocation technique on the general portfolio and particular person holding degree to find out your optimum place, together with:

- First In, First Out (FIFO) – Sharesight assumes that you simply promote your longest held shares first

- Final In, First Out (LIFO) – Sharesight assumes that you simply promote your most lately bought shares first

- Maximise Achieve – Sharesight assumes that you simply promote shares with the bottom buy worth first

- Minimise Achieve – Sharesight assumes that you simply promote shares with the very best buy worth first

- Minimise CGT – Sharesight assumes that you simply promote shares that can consequence within the lowest capital positive factors tax first. This technique is extra refined than the ‘Minimise capital achieve’ technique as a result of it takes under consideration the Australian CGT discounting guidelines.

Notes on the unrealised CGT report

- The unrealised CGT report is designed for forecasting functions solely. Seek advice from the capital gains tax report to calculate your precise (realised) taxable capital achieve revenue for a selected interval

- You possibly can carry ahead losses from the earlier reporting interval by clicking on the ‘Superior choices’ hyperlink

- It’s a good suggestion to run the report all year long, not simply on the finish, with a purpose to keep on high of alternatives to offset positive factors and losses all year long. You might wish to share secure portfolio access together with your accountant and/or adviser, to allow them to hold this in thoughts as properly

- The unrealised CGT report is on the market on Australian investor and expert plans

- For extra data, see our tutorial video beneath:

Avoiding wash gross sales

In 2008, the Australian Tax Workplace (ATO) issued issued tax ruling TR 2008/1, which particularly outlaws preparations the place “…in substance there is no such thing as a vital change within the taxpayer’s financial publicity to, or curiosity in, the asset, or the place that publicity or curiosity could also be reinstated by the taxpayer”.

In different phrases, the ATO prevents buyers from promoting a inventory in a single monetary yr to benefit from a capital loss occasion, solely to purchase that inventory once more within the new monetary yr. This is named a “wash sale” and the ATO will disallow the loss if the only intention of the sale was to minimise tax. As Sharesight Govt Director Andrew Bird says, “if you’ll promote, be sure to actually imply it. For those who nonetheless consider in that inventory then select a special ‘loser’ to promote to offset your achieve”.

Calculate tax loss promoting alternatives with Sharesight

Be part of hundreds of Australian buyers already utilizing Sharesight to trace their funding portfolios and optimise their CGT place. Sign up for Sharesight you may:

Sign up for a FREE Sharesight account and get began monitoring your funding efficiency (and tax) right now.

FURTHER READING

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)