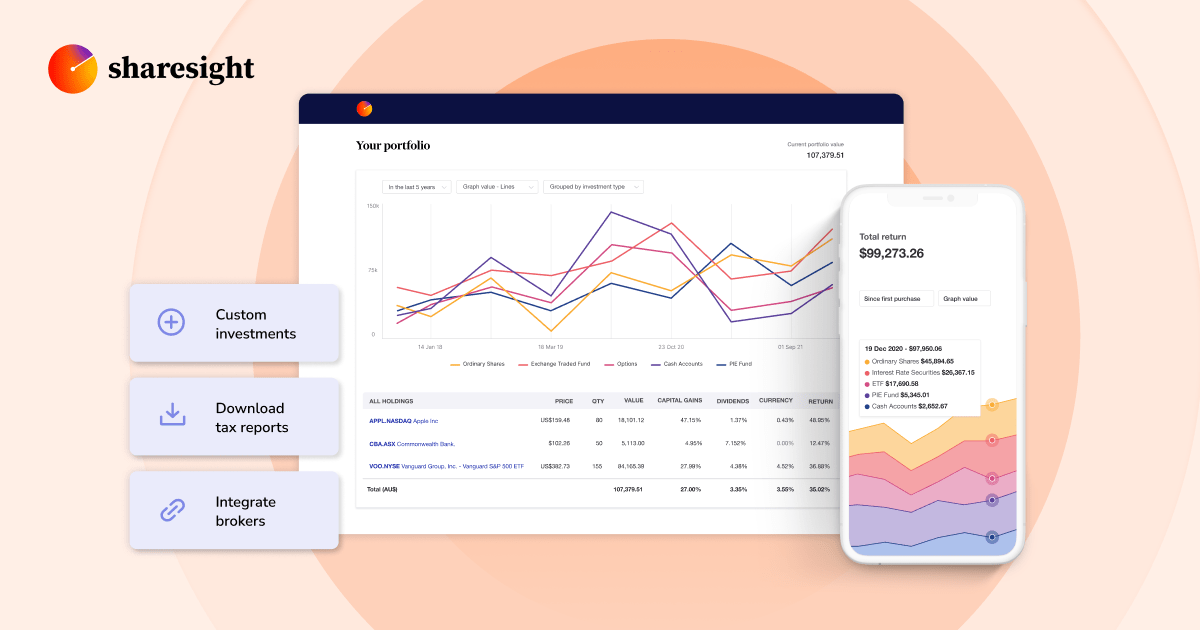

In at present’s complicated funding panorama, having the precise portfolio monitoring device is not simply handy, it is important. With quite a few portfolio trackers obtainable, how does Sharesight evaluate to options? As traders ourselves, we have constructed Sharesight to deal with actual portfolio administration challenges, and we’re happy with how our answer stacks up in opposition to opponents.

On this comparability, we study key options that matter most to critical traders, serving to you perceive why over 500,000 traders worldwide belief Sharesight with their portfolio monitoring wants.

World markets protection: Complete funding monitoring

✅ Sharesight: Sharesight helps over 60 stock exchanges world wide with automated pricing updates for shares, ETFs, and listed entities from across the globe. This in depth protection makes Sharesight probably the most complete portfolio tracker obtainable. You’ll be able to routinely monitor worth, efficiency and dividends from 750,000+ international shares, crypto, ETFs and funds.

❌ Alternate options: Many credible options exist, however they usually do not provide the in depth international protection that Sharesight offers. This limitation might be problematic for traders with worldwide portfolios.

Portfolio and ETF X-ray: Unparalleled transparency by way of the publicity report

✅ Sharesight: Sharesight is the one portfolio tracker that may present your exposure to particular sectors, nations, and even corporations inside your ETFs, alongside along with your direct holdings in these corporations, serving to you cut back ETF overlap. Obtainable for ETFs domiciled in Australian, New Zealand, United Kingdom, USA and Canada.

❌ Alternate options: To our information, no different portfolio tracker provides this degree of transparency and element, leaving traders with out clear visibility into their true exposures.

Mutual/managed funds protection: World perspective

✅ Sharesight: Sharesight has in depth protection of managed funds in Australia, New Zealand, the US, UK, Canada, Eire, Luxembourg, and extra — which is very essential for household workplaces and excessive internet price traders.

❌ Alternate options: Few opponents match our breadth of protection for managed funds, creating blind spots for traders with diversified portfolios.

Unlisted investments: Past conventional belongings

✅ Sharesight: Versatile customized funding options mean you can monitor different investments like artwork, actual property, or classic automobiles alongside listed investments utilizing the identical constant methodology.

❌ Alternate options: Whereas some opponents present related capabilities, they usually lack the seamless integration that Sharesight provides, making a fragmented view of your general wealth.

Portfolio threat reporting: Superior insights

✅ Sharesight: With Sharesight, you possibly can analyse your portfolio by way of the lens of maximum drawdown risk, offering invaluable insights into your true portfolio threat profile.

❌ Alternate options: No different portfolio tracker provides this particular form of threat reporting at each the portfolio and particular person funding degree, leaving traders with incomplete threat evaluation.

✅ Sharesight: We embody an entire set of tax instruments and stories (for Australian, NZ and Canadian traders) in our paid plans, designed to simplify tax time.

❌ Alternate options: Whereas established opponents might provide related instruments, many more recent entrants lack these important options, probably complicating your tax preparation.

Longevity: Confirmed monitor file

✅ Sharesight: Sharesight was established in 2007 by a father-son duo from Wellington, NZ. Over the previous 15+ years, we have constructed knowledgeable staff centered on product improvement, buyer help, safety and advertising, now serving prospects in over 100 nations.

❌ Alternate options: Many options have come and gone as solo operations that could not maintain themselves long-term on this aggressive market.

Information aggregation: Safe and dependable

✅ Sharesight: We work diligently to assemble buyer suggestions and enhance our knowledge assortment strategies, utilizing respected intermediaries and APIs to make sure dependable knowledge integration.

❌ Alternate options: Some opponents use screen-scraping applied sciences to gather knowledge from brokers and different sources — strategies that could be borderline unlawful and lift important safety considerations.

Safety: Your funding monitoring deserves safety

✅ Sharesight: With a devoted belief and safety staff, we take your data safety significantly and are presently enterprise quite a few safety and compliance initiatives throughout all points of our enterprise. Our comprehensive security approach offers user-controlled entry, safe authentication with optionally available 2FA, enterprise-grade encryption, automated international backups, and common impartial safety audits.

❌ Alternate options: We strongly encourage you to look at the safety credentials of any different you are contemplating — in any case, it is your life’s investments and knowledge at stake.

Trusted by establishments and professionals

✅ Sharesight: Our portfolio tracker is trusted by massive institutional companions akin to Morningstar, CMC Markets and quite a few monetary professionals worldwide.

❌ Why this issues: Institutional adoption demonstrates the reliability and accuracy of our platform, giving particular person traders confidence that they are utilizing professional-grade instruments.

Making your selection

When choosing a portfolio tracker, take into account these key components:

- World protection that matches your funding technique

- Transparency into underlying holdings, particularly for ETFs and funds

- Complete asset help throughout listed and unlisted investments

- Threat and tax reporting capabilities

- Firm stability and monitor file

- Information safety and greatest in school privateness practices.

Whereas there are a lot of options available in the market, Sharesight constantly delivers throughout all these dimensions, making it the popular selection for critical traders globally.

Who’s Sharesight for?

Sharesight has been designed to serve a variety of traders, but it surely significantly excels for:

DIY traders

Whether or not you are managing a modest portfolio or substantial wealth, Sharesight offers the instruments to trace efficiency, cut back tax complications and make knowledgeable choices. From skilled traders wanting deeper insights throughout the three dimensions of efficiency reporting, asset allocation and threat primarily based determination making to newbie traders seeking to perceive their returns and tax reporting, our platform scales to fulfill your wants.

In a assessment of all portfolio trackers, Investopedia named Sharesight as being the best for DIY investors.

World traders

In the event you make investments throughout a number of nations or exchanges, Sharesight’s complete international protection is invaluable. Not will you want separate instruments to trace your US, European, Asian or Australian investments — the whole lot is in a single place with correct forex conversion and efficiency monitoring.

ETF & fund traders

For these with important investments in ETFs and managed funds, our distinctive X-ray function reveals what’s actually in your portfolio, serving to you keep away from unintended focus dangers and optimise your asset allocation.

Buyers with various asset varieties

In case your portfolio extends past shares to incorporate property, cryptocurrency, personal investments or collectibles, Sharesight provides the flexibleness to trace the whole lot in a single consolidated view with constant efficiency methodology.

Revenue traders

Buyers who depend on dividend earnings to complement their earnings or retirement will discover our earnings reporting options to be complete and indispensable for monitoring and forecasting their dividend earnings stream.

Monetary professionals

Accountants, monetary advisors and household workplaces use Sharesight to supply higher service to their purchasers, with our skilled plans providing multi-portfolio administration and shopper reporting options.

Strive Sharesight at present

See for your self why traders select Sharesight over options. Our platform provides a free tier for traders simply getting began, with premium options obtainable for these with extra complicated portfolios.

Sign up for a free Sharesight account or view our pricing plans to seek out the precise choice to your funding wants.

Disclaimer: This comparability relies on our analysis and understanding of competitor choices as of 19 Mar 2025. Options and capabilities of different platforms might change over time.

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)