Irish companies are sitting on a goldmine of untapped tax reduction. But many don’t even understand it exists.

The Analysis and Growth (R&D) tax credit score scheme in Eire affords corporations as much as 30% again on qualifying innovation expenditure. This isn’t simply theoretical cash, it’s actual money that may rework your online business’s monetary place and gas your subsequent part of progress.

For e-commerce manufacturers creating new platforms, advertising and marketing businesses creating proprietary instruments, or SaaS corporations constructing cutting-edge software program, R&D tax credit signify one of the vital priceless monetary incentives obtainable. The scheme has change into more and more beneficiant, with the credit score price leaping from 25% to 30% in 2024, making it extra enticing than ever for Irish SMEs and tech startups.

This information will stroll you thru the whole lot you must find out about R&D tax credit in Eire. You’ll uncover what qualifies, how one can declare, and most significantly, how one can maximise your reduction to reinvest in innovation and progress. Whether or not you’re a startup creating your first product or a longtime SME trying to increase, understanding R&D tax credit may very well be the monetary increase your online business wants.

Understanding R&D Tax Credit In Eire

The R&D tax credit score is Eire’s approach of encouraging corporations to innovate and develop new applied sciences, merchandise, and processes. It’s not only a small perk, it’s a considerable monetary incentive that may considerably impression your backside line.

What precisely is the R&D tax credit score?

The R&D tax credit score permits qualifying corporations to say a credit score of 30% in opposition to their company tax legal responsibility for expenditure on eligible analysis and growth actions. In case your credit score exceeds your company tax invoice, you’ll be able to carry it ahead to be used in future years or, in sure circumstances, obtain a refund.

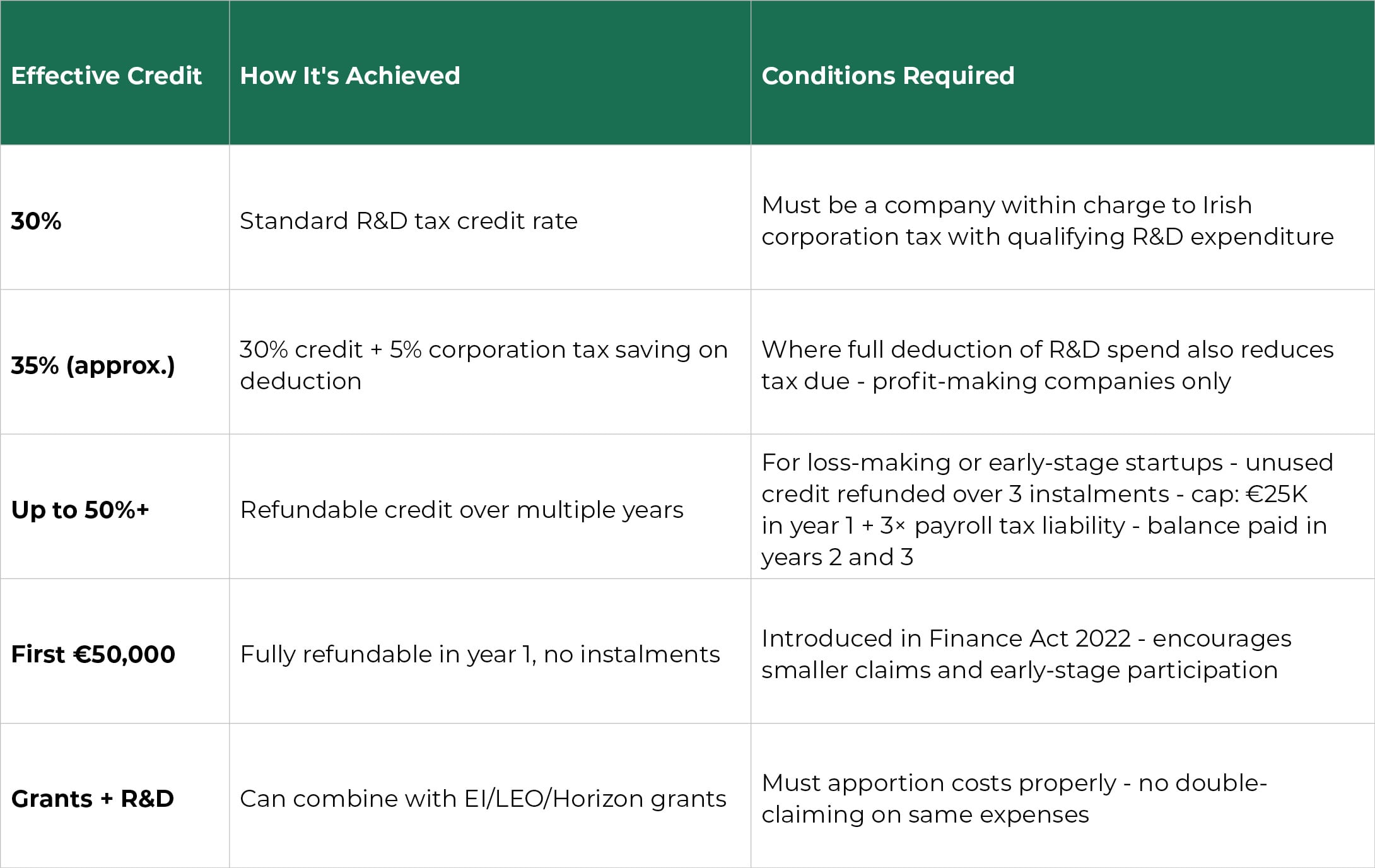

R&D Tax Credit score Charges in Eire (2024–2025)

Understanding the efficient charges obtainable may help you propose your R&D actions extra strategically:

Key factors to grasp:

- 30% is the core price of credit score on qualifying R&D spend (elevated from 25% pre-2024)

- In the event you’re worthwhile, chances are you’ll get an efficient profit of roughly 35% because of each the R&D credit score and company tax deduction on the identical prices

- In the event you’re pre-profit, the credit score is refundable, topic to limits and break up over three years (aside from the primary €50K which is refunded up-front)

- Income operates a three-year instalment mannequin for refunds, however the first €50K rule helps startups considerably

Key eligibility standards embody

- Your organization have to be included and tax resident in Eire or have a department right here

- You have to be topic to Irish company tax

- The R&D actions should advance general information or functionality in a discipline of science or know-how

- The work should contain considerable novelty and technical uncertainty

- The actions have to be undertaken systematically by certified individuals

For SMEs and tech corporations, this usually covers a variety of actions you’re in all probability already doing. Software program growth initiatives, creating new algorithms, creating proprietary methods, and bettering current processes usually qualify.

Qualifying actions for tech-focused companies

The scope of qualifying R&D is broader than many enterprise homeowners realise. For e-commerce manufacturers, this may embody creating new buyer advice methods, creating progressive cost processing options, or constructing superior analytics platforms. Advertising and marketing businesses usually qualify once they’re creating proprietary instruments for marketing campaign administration, creating new knowledge evaluation methodologies, or constructing customized reporting methods.

SaaS corporations have quite a few qualifying actions. From core product growth to creating new integrations, bettering safety protocols, or creating AI-powered options. Even course of enhancements can qualify in the event that they contain real technical innovation and uncertainty.

Qualifying expenditure classes

- Worker prices: Salaries and advantages for employees straight concerned in R&D actions

- Supplies and consumables: Software program licences, cloud computing prices, and different supplies utilized in R&D

- Plant and equipment: Tools used completely for R&D functions (topic to sure restrictions)

- Overheads: A portion of normal enterprise prices that help R&D actions

- Contracted R&D: Funds to 3rd events for R&D providers

Latest legislative adjustments

The Irish authorities elevated the R&D tax credit score price from 25% to 30% for expenditure incurred from 1 January 2024. This transformation makes the scheme much more enticing and demonstrates the federal government’s dedication to supporting innovation in Irish companies.

Integration with different incentives

The R&D tax credit score works alongside different helps obtainable to Irish companies. You’ll be able to mix it with varied grants and funding programmes, although you must watch out about double-claiming for a similar expenditure. The credit score additionally interacts with different tax reliefs, and correct planning may help you maximise the general profit.

Monetary Advantages Of R&D Tax Aid

The monetary impression of R&D tax credit in Eire extends far past easy tax financial savings. For rising companies, these credit may be transformational.

Rapid monetary advantages

The obvious benefit is the direct discount in your company tax legal responsibility. For an organization spending €100,000 on qualifying R&D actions, the 30% credit score supplies €30,000 in tax reduction. This isn’t a deduction, it’s a direct credit score in opposition to your tax invoice.

In case your R&D credit score exceeds your company tax legal responsibility, you’ll be able to carry the surplus ahead indefinitely. SMEs may additionally be eligible for a payable credit score in sure circumstances, offering fast money stream advantages.

Money stream enhancements

R&D credit can considerably enhance your working capital place. Many companies use the anticipated credit score to safe higher financing phrases or scale back their reliance on exterior funding. The predictable nature of the reduction makes monetary planning extra easy.

Sector-specific benefits

E-commerce manufacturers profit notably from R&D credit when creating proprietary know-how platforms, creating progressive buyer expertise instruments, or constructing superior logistics and fulfilment methods. These companies usually have substantial software program growth prices that qualify for reduction.

Advertising and marketing businesses can declare credit for creating new analytical instruments, creating proprietary marketing campaign administration methods, or constructing progressive reporting platforms. The digitisation of promoting has created quite a few alternatives for qualifying R&D actions.

SaaS corporations sometimes have the best proportion of qualifying expenditure, as their core enterprise actions usually contain steady product growth, characteristic enhancement, and technical innovation.

Funding attraction and scaling

R&D credit make your online business extra enticing to traders. The tax effectivity demonstrates good monetary administration, whereas the qualifying actions present real innovation. Many traders view constant R&D credit score claims as a constructive indicator of an organization’s technical capabilities and progress potential.

Aggressive positioning

Corporations that successfully use R&D credit can reinvest the financial savings in additional innovation, making a virtuous cycle of growth and tax reduction. This offers them a major benefit over opponents who aren’t maximising obtainable incentives.

Overcoming R&D Credit score Limitations

Regardless of the substantial advantages obtainable, many eligible companies don’t declare R&D tax credit. Understanding the widespread misconceptions and challenges may help you keep away from these pitfalls.

“We’re not doing actual R&D”

That is the largest false impression we come throughout. Many enterprise homeowners assume R&D solely applies to corporations in white coats working in laboratories. In actuality, if you happen to’re fixing technical issues, creating new software program options, or bettering processes by way of innovation, you’re probably doing qualifying R&D.

The important thing take a look at isn’t whether or not you name it “analysis and growth”. It’s whether or not your actions advance general information or functionality in science or know-how by way of systematic investigation.

“Our business doesn’t qualify”

Revenue guidance makes it clear that R&D tax credit in Eire apply throughout all sectors. We’ve efficiently claimed credit for companies in retail, skilled providers, manufacturing, and quite a few different industries. The main focus is on the actions, not the sector.

“We’re too small to learn”

There’s no minimal dimension requirement for R&D tax credit. A few of our most profitable claims have been for startups and small companies. In truth, smaller corporations usually profit extra as a result of the credit signify a bigger proportion of their tax legal responsibility.

Documentation and record-keeping challenges

Many companies battle with the documentation necessities. You want to keep detailed information of qualifying actions, expenditure, and the technical uncertainties you’ve addressed.

This contains:

- Venture documentation and technical specs

- Time information for employees concerned in R&D actions

- Monetary information linking expenditure to particular initiatives

- Proof of technical challenges and the way they have been resolved

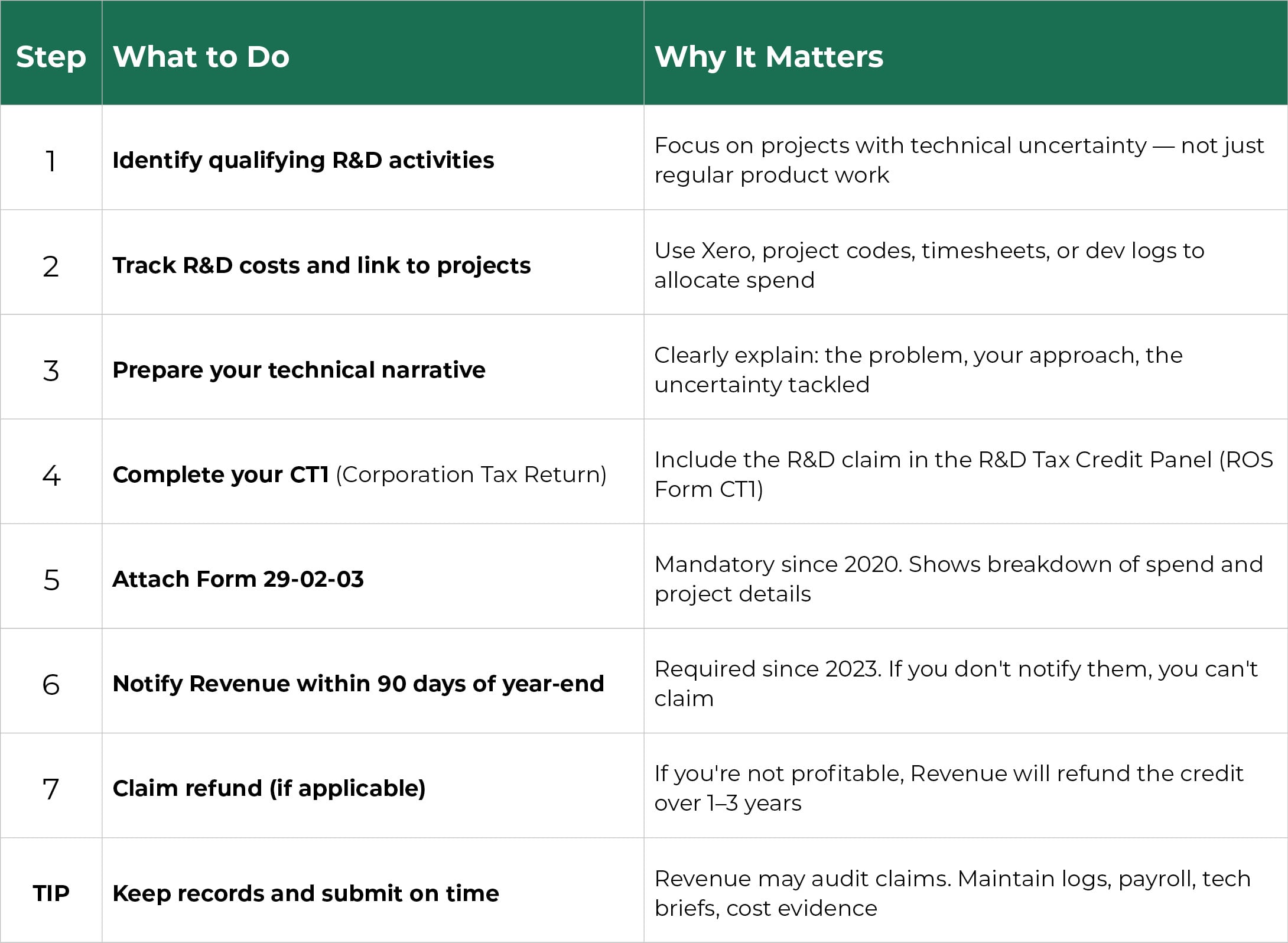

The 90-day notification requirement

One essential requirement that catches many companies off-guard is the necessity to notify Income of your intention to make an R&D declare inside 90 days of your accounting year-end. Miss this deadline, and you might lose your entitlement fully.

This notification doesn’t want to incorporate full particulars. It’s merely alerting Income that you just intend to make a declare. Nonetheless, it’s completely important and non-negotiable.

Integration with accounting methods

Correctly monitoring R&D expenditure requires good monetary methods. Many companies battle to separate qualifying prices from normal enterprise expenditure. That is the place skilled accounting software program turns into important.

At Round Finance, we assist shoppers arrange their methods to mechanically categorise and observe R&D expenditure, making the declare course of rather more easy.

How one can Declare the R&D Tax Credit score (Step-by-Step for 2025)

Efficiently claiming R&D tax credit in Eire requires a scientific method. Right here’s the whole course of for maximising your declare whereas assembly all compliance necessities.

Key reminders in your declare

- First €50,000 of a declare is refundable in full in Yr 1 — no instalments

- If claiming for contracted R&D, embody contractor particulars

- Income requires project-by-project breakdown — no obscure bundling

- Begin monitoring from the start of the yr, not at year-end

- Embrace all qualifying prices, together with people who may appear minor

- Don’t neglect about qualifying overheads – these may be substantial

- Contemplate whether or not any capital expenditure qualifies

- Evaluate earlier years to establish missed alternatives

Widespread pitfalls to keep away from

- Claiming non-qualifying actions or expenditure

- Inadequate documentation to help the declare

- Lacking the 90-day notification deadline

- Double-counting expenditure that’s already been grant-funded

- Insufficient technical descriptions within the narrative report

Combining R&D Credit With Further Funding

R&D tax credit work finest as a part of a broader funding technique. Eire affords quite a few grants and helps that complement the tax credit score scheme.

Key grant programmes for tech companies

Enterprise Eire affords a number of schemes that work properly alongside R&D credit:

- Innovation Partnerships: Funding for collaborative R&D initiatives

- R&D Fund: Direct funding for analysis and growth actions

- Public Service Stability Enterprise (PSSU): Authorities-backed settlement supporting public sector workforce stability and collaboration, not directly benefiting innovation and startups.

Native Enterprise Workplaces present help for smaller companies, together with feasibility grants and enterprise growth funding.

EU programmes like Horizon Europe supply substantial funding for progressive initiatives, notably these involving worldwide collaboration.

Strategic mixture of helps

The important thing to maximising obtainable funding is knowing how totally different helps work together. You usually can’t declare R&D tax credit in Eire on expenditure that’s already been grant-funded, however you’ll be able to usually construction initiatives to profit from each.

For instance, you may use grant funding to cowl the preliminary analysis part of a mission, then declare R&D tax credit on the next growth and commercialisation actions.

Planning for optimum profit

Efficient funding methods require ahead planning:

- Map out your innovation pipeline for the following 2-3 years

- Determine which actions are finest suited to grant funding versus tax credit

- Time your purposes to align along with your growth schedule

- Preserve clear separation between grant-funded and tax credit score actions

For an entire overview of obtainable help, you’ll be able to entry our information to ‘Every Business Grant And Support Available In Ireland’, which supplies detailed details about dozens of programmes which may profit your online business.

Why Companion With Round Finance

Claiming R&D tax credit successfully requires experience in each technical and monetary areas. At Round Finance, we concentrate on serving to e-commerce manufacturers, advertising and marketing businesses, and tech startups maximise their R&D reduction whereas constructing sturdy monetary methods for progress.

Our sector experience:

We perceive the distinctive challenges and alternatives in your business. Our expertise with tech startup businesses means we all know what actions are prone to qualify and how one can current them successfully to Income.

For e-commerce manufacturers, we assist establish qualifying actions in areas like platform growth, buyer expertise innovation, and logistics optimisation. Advertising and marketing businesses profit from our understanding of how digital device growth and course of innovation qualify for reduction.

Complete service method:

Our R&D tax credit score service goes past easy compliance:

- Strategic planning: We assist establish R&D alternatives and construction actions to maximise reduction

- Methods integration: We arrange your accounting methods to mechanically observe qualifying expenditure

- Documentation help: We assist create and keep the information wanted to help your claims

- Ongoing compliance: We deal with all interactions with Income and guarantee deadlines are met

Expertise integration:

We’re specialists in integrating R&D monitoring along with your current accounting methods. Whether or not you’re utilizing Xero, QuickBooks, Sage, or Surf Accounts, we will arrange automated processes to seize and categorise qualifying expenditure all year long.

Past compliance:

What units Round Finance aside is our give attention to utilizing monetary knowledge to drive enterprise progress. R&D tax credit are only one a part of a complete monetary technique that features money stream administration, progress planning, and strategic determination help.

Able to discover your R&D tax credit score alternatives? Contact us for a session the place we’ll overview your online business actions and establish potential areas for reduction.

The time to behave is now. Your future progress is dependent upon the monetary selections you make in the present day

FAQs

Do I have to be a big firm to qualify for R&D tax credit?

No, there’s no minimal dimension requirement. SMEs and startups usually profit essentially the most from R&D credit.

What occurs if my R&D credit score exceeds my company tax invoice?

You’ll be able to carry the surplus credit score ahead indefinitely or, in sure circumstances, obtain a refund.

Can I declare R&D credit on software program growth prices?

Sure, software program growth that entails technical innovation and uncertainty sometimes qualifies for R&D credit.

What’s the 90-day notification rule?

It’s essential to notify Income inside 90 days of your year-end that you just intend to make an R&D declare, otherwise you’ll lose entitlement.

Can I mix R&D tax credit with grants?

Sure, however you can not declare R&D credit on expenditure that’s already been grant-funded.

Do advertising and marketing businesses qualify for R&D tax credit?

Sure, when creating proprietary instruments, creating new methodologies, or constructing progressive methods.

What if Income challenges my R&D declare?

Having correct documentation {and professional} help considerably reduces the chance of profitable challenges.

Can I declare R&D credit on course of enhancements?

Sure, if the enhancements contain real technical innovation and advance information in your discipline.

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)