The 2024-2025 monetary yr was eventful to say the least. Elections within the US, UK and Australia, battle within the Center East, on once more/off once more tariffs and one other yr of struggle within the Ukraine.

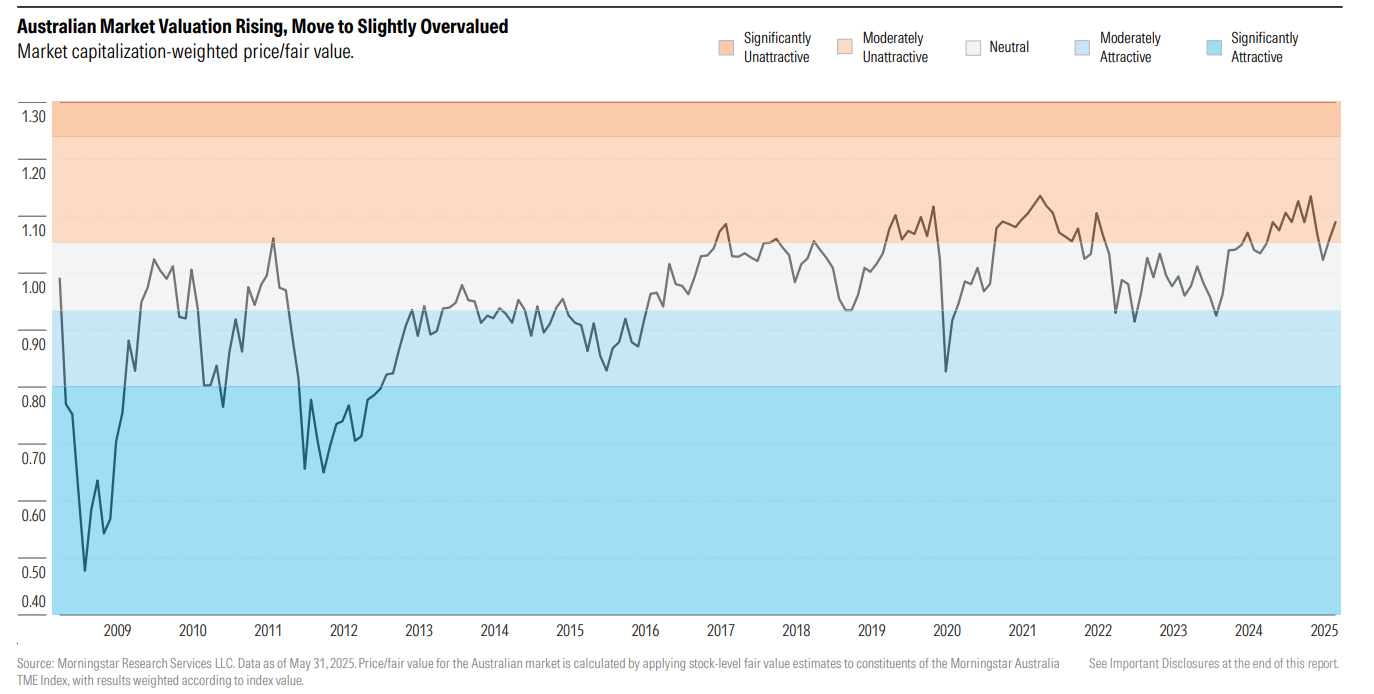

Markets zigged and zagged with the information cycle however are on observe for wholesome good points for the yr for traders who stayed the course. Australian shares finish the yr in overvalued territory though there have been alternatives over the course of the yr to select up shares on sale.

The beginning of the monetary yr is a time to replicate on the yr that’s gone. This contains understanding whether or not the holdings in your portfolio nonetheless match your funding technique. Additionally it is a time to replicate on the thesis for every of your holdings and in the event that they nonetheless apply.

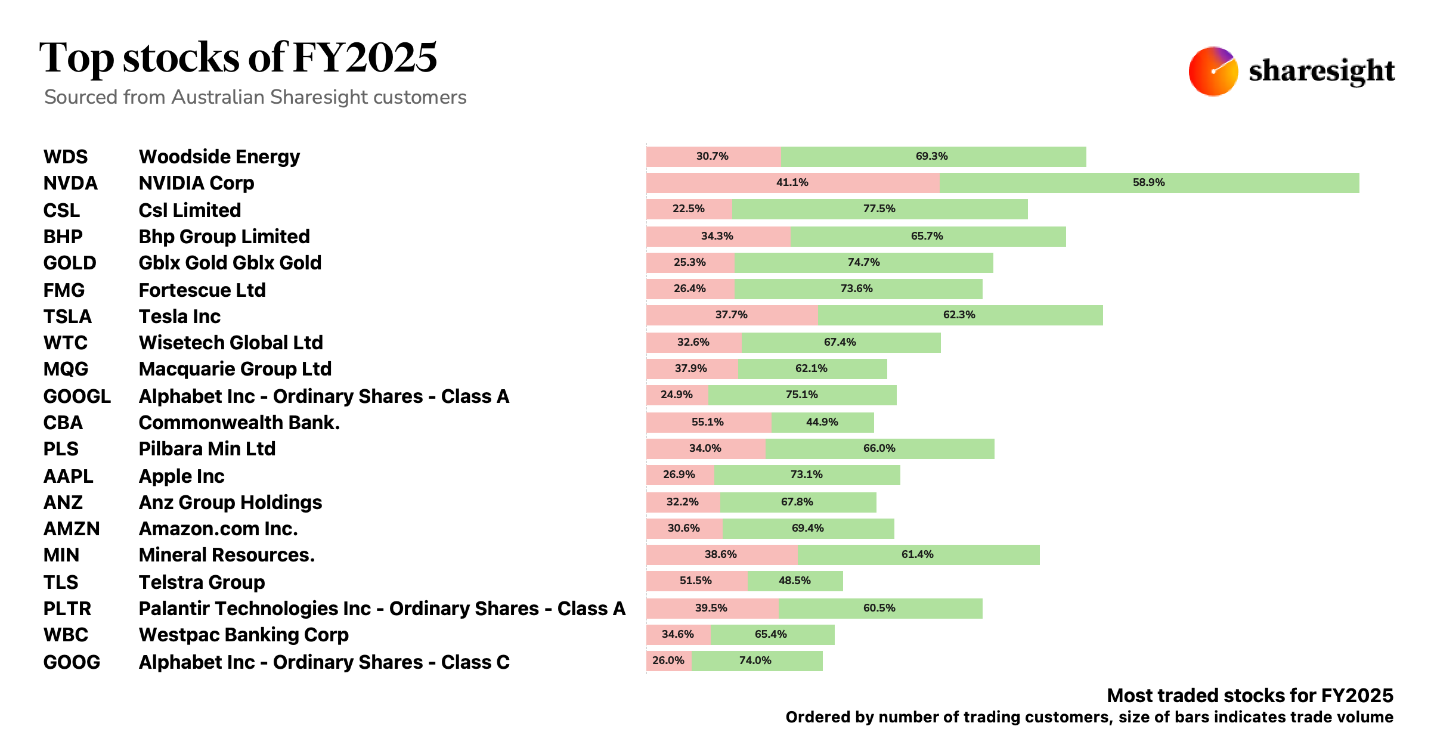

Right here’s what our Morningstar analysts take into consideration the highest three fairness trades for the 24/25 monetary yr.

Woodside Vitality (ASX: WDS)

- Honest Worth estimate: $41.50 (41% low cost at 25 June)

- Moat: None

- Uncertainty Ranking: Medium

- Star Ranking: ★★★★★

Woodside is Australia’s premier oil and gasoline firm with operations throughout liquid pure gasoline, pure gasoline, condensate and crude oil. LNG pursuits within the North West Shelf Joint Enterprise, or NWS/JV, and Pluto offshore Western Australia are the agency’s mainstay, and the low-cost benefit of those property type the inspiration for Woodside.

A giant chunk of Morningstar Fairness Analyst Mark Taylor’s intrinsic worth estimate for Woodside comes from future venture improvement. That is each an advanced and costly endeavor, however it’s one which Woodside has excelled in for over 25 years and has unparalleled expertise domestically.

Woodside additionally advantages from 20-year off-take agreements with a number of blue-chip Asian power utilities together with Tokyo Electrical, Kansai Electrical, Chubu Electrical, and Osaka Gasoline. These assist guarantee adequate venture financing throughout improvement and also needs to add stability to money flows after completion.

Woodside’s deep improvement pipeline is backed up by what Taylor views as a beautiful medium-term demand image for gasoline, which is a far cleaner power supply than coal and due to this fact ought to play an necessary position in decreasing international emissions.

When it comes to dividends, Woodside’s official coverage is to pay out a minimal of fifty% of underlying earnings to shareholders. Since 2013, although, this has risen to roughly 80% of earnings as Woodside put a lot of its LNG growth plans on maintain. Taylor thinks that is excessive and suggests the funds may probably be higher used to speed up the corporate’s progress investments.

Nonetheless, Woodside has robust cashflow and a wholesome steadiness sheet that ought to help ongoing dividend funds which are 100% franked. Taylor expects a fiscal 2026 ahead yield of round 7.10%. At a latest share value of $24.16 the corporate’s shares display screen as materially undervalued versus his $41.50 Honest Worth Estimate.

NVIDIA Corp (NASDAQ: NVDA)

- Honest Worth estimate: $140.00 (Pretty valued at 26 June)

- Moat: Huge

- Uncertainty Ranking: Very Excessive

- Star Ranking: ★★★

With a nascent expertise sector in Australia comparative to the US, we see traders trying in the direction of America for publicity to the AI pattern. Main the cost is NVIDIA due to its market management in graphics processing items, or GPUs. GPUs are {hardware} and software program instruments wanted to allow the exponentially rising market round synthetic intelligence.

Morningstar’s analysts award NVIDIA a large moat, indicating that they consider the corporate is ready to preserve and develop their aggressive benefit for not less than the subsequent twenty years. They do anticipate that many bigger tech corporations will attempt to seek out in-house options or second sources of options to cut back reliance on NVIDIA, however whereas these efforts might chip away at NVIDIA’s AI dominance, they’re unlikely to unseat it.

Our analysts additionally consider that NVIDIA is in excellent monetary well being. As of April 2025, the corporate held $53.7 billion in money and investments, as in contrast with $8.5 billion in short-term and long-term debt. We expect the agency generates adequate money stream and has ample assets to fulfill its debt obligations, capital expenditure necessities, potential acquisitions, and shareholder returns.

Our Honest Worth Estimate is tied to NVIDIA’s prospects within the AI market and prospects within the knowledge centre. It’s anticipated that they received’t be unbothered within the high spot, with main cloud distributors persevering with to put money into their very own in-house options, whereas AMD is engaged on GPUs and AI accelerators for the info centre. Proper now, it’s a sport of chasing NVIDIA who’s forward of the pack. The valuation hinges on how lengthy NVIDIA can preserve this place.

There’s confidence that NVIDIA will have the ability to preserve their place for the foreseeable future. Their place is protected by Cuda, a proprietary software program platform. These instruments permit AI builders to construct their fashions with NVIDIA. We consider NVIDIA not solely has a {hardware} lead, however advantages from excessive buyer switching prices round Cuda, making it unlikely for an additional chip designer to emerge as a frontrunner in AI coaching.

Over the course of the 24/25 FY, the share managed to comfortably outperform the NASDAQ 100. NVIDIA is pretty valued in opposition to Morningstar’s Honest Worth Estimate on the finish of June.

CSL Restricted (ASX: CSL)

- Honest Worth estimate: $325 (26% low cost at 26 June)

- Moat: Slender

- Uncertainty Ranking: Medium

- Star Ranking: ★★★★

CSL is one in all three tier one plasma remedy corporations that profit from an oligopoly in a extremely consolidated market. All of the gamers are vertically built-in as plasma sourcing is a key constraint in manufacturing. The plasma sourcing market is at present briefly provide, nevertheless, CSL is properly positioned having invested considerably in plasma assortment centres, proudly owning roughly 30% of assortment centres globally.

We award CSL a slim moat ranking primarily based on the fee benefit afforded by its large-scale plasma assortment and fractionation (that is the place the assorted parts of blood plasma are separated). A slim moat signifies that our analysts consider that CSL will have the ability to preserve and develop their earnings for not less than the subsequent 10 years.

CSL additionally possesses intangible property primarily based on the mental capital in its present merchandise and the confirmed success of its R&D efforts over time. The trade has excessive limitations to entry as plasma fractionation has lengthy lead occasions, taking roughly seven years to be constructed and authorized. Fractionation can be a fancy course of that requires important experience and scale to be carried out cost-effectively.

Our analysts consider that CSL additionally demonstrates a smart strategy to R&D, evaluating spend primarily based on the industrial outlook. The technique for CSL has been to focus on uncommon ailments, sometimes low quantity and excessive value and margin companies.

CSL is at present thought of 26% undervalued to its Honest Worth Estimate of $325 on the finish of June. It has underperformed considerably in the course of the 24/25 monetary yr. The share value has continued to say no since reporting interim ends in February 2025, with no materials bulletins. If an investor had chosen to put money into a broad market index ETF such because the Vanguard Australian Shares Index ETF VAS, they’d have bested CSL by just below 30%. Nevertheless, this has created a beautiful alternative for a moated firm, with its core enterprise in fine condition.

My colleague Mark LaMonica, CFA joined the ranks of Sharesight customers who bought CSL Ltd in the course of the Monetary 12 months. He has written about his course of to incorporate it into his portfolio, and his evaluation of the share in opposition to his portfolio targets.

Extra from Morningstar

This text has been ready by Morningstar Australasia Pty Ltd (AFSL: 240892). The knowledge is basic in nature and doesn’t think about the monetary scenario of any particular person. For extra data discuss with our Monetary Companies Information at www.morningstar.com.au/s/fsg.pdf. It’s best to think about the recommendation in gentle of those issues and if relevant, the related Product Disclosure Assertion earlier than making any choice to speculate. Previous efficiency doesn’t essentially point out a monetary product’s future efficiency. To acquire recommendation tailor-made to your scenario, contact an expert monetary adviser.

Morningstar’s publications, scores and merchandise ought to be considered as a further funding useful resource, not as your sole supply of data. Morningstar’s full analysis studies are the supply of any Morningstar Scores and can be found from Morningstar or your adviser. Some materials is copyright and printed underneath licence from ASX Operations Pty Ltd ACN 004 523 782.

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)