Disclaimer: This text is for informational functions solely and doesn’t represent a particular product advice, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use cheap endeavours to maintain the data up-to-date, we make no illustration that any data is correct or up-to-date. Should you select to utilize the content material on this article, you achieve this at your individual threat. To the extent permitted by legislation, we don’t assume any accountability or legal responsibility arising from or related together with your use or reliance on the content material on our website. Please examine together with your adviser or accountant to acquire the right recommendation in your scenario.

Final month, we had the pleasure of attending and exhibiting at SIAA’s 2025 convention in Sydney. The occasion introduced collectively professionals from throughout the funding business to share insights, talk about market traits, and discover the way forward for monetary recommendation. From keynote speeches to panel discussions, it was a useful alternative to attach with friends and keep throughout key developments within the sector.

For many who have been unable to attend, here’s a abstract of a number of the standout periods and takeaways from the occasion.

The Sharesight staff at SIAA 2025

World financial outlook

(By Luci Ellis, Chief Economist at Westpac Banking Group)

China’s outlook and its implications for Australia

China stays Australia’s largest buying and selling associate and a extra important driver of Australian financial outcomes than the US. The present forecast suggests China will obtain its official 5% development goal in 2025 — an end result not absolutely priced in by monetary markets. Indicators such because the Australian greenback and commodity costs replicate some market scepticism. If development targets are met, a repricing of threat and alternative is prone to comply with.

European markets, notably in defense-related equities, have carried out strongly. In some jurisdictions, protection is now being built-in into ESG frameworks. Investor sentiment towards Europe has advanced, with growing recognition of development and competitiveness in economies outdoors the core euro space — particularly in Jap Europe.

China’s structural transition and the metal market

China has probably reached the purpose of “peak metal” on a per capita foundation. Historic information from varied superior economies exhibits that metal consumption per capita stabilises as soon as a sure degree of GDP per capita is reached. Analysis from the Reserve Financial institution of Australia (2017) anticipated this improvement. Since round 2020–2021, Chinese language metal manufacturing has plateaued, following twenty years of fast growth.

For Australia, this suggests restricted additional upside in iron ore export volumes. Nonetheless, iron ore will stay a considerable income, supplied Chinese language GDP development stays close to present targets (5.0% in 2025, 4.6% in 2026). The export worth stays important, whilst quantity development flattens.

Australia’s publicity to US tariffs

Australia falls beneath the ten% tariff class, which is relatively reasonable. The US, whereas amongst Australia’s prime 5 export locations, accounts for less than about 8% of whole exports. A good portion of those are providers. For instance, software program licensing accounted for $7.5 billion in export earnings in 2024 — surpassing many conventional items exports. A lot of that is directed to the US and isn’t topic to tariffs.

The general impression of US tariffs on Australian GDP is subsequently anticipated to be restricted. Development forecasts have been modestly revised, however no substantial downturn is anticipated.

Inflation and financial coverage

Latest inflation information means that worth pressures, notably in housing, could also be easing. Hire inflation rose following the reopening of borders post-COVID, on account of a surge in migration. This has now began to unwind. Structural constraints within the building sector restricted the power to reply quickly with new housing provide.

The RBA has adopted a cautious method to charge cuts, prioritising a return to its 2–3% inflation goal vary. Nonetheless, the inflation trajectory seems to help additional easing. Non-public sector demand stays weak, and labour market tightness is concentrated in care-related sectors, that are unlikely to maintain present development ranges indefinitely.

Looking forward to 2026

Outcomes for 2026 will rely closely on world commerce dynamics and the medium-term results of the present commerce coverage shifts. Whereas preliminary tariff bulletins have been regarding, revised phrases recommend a decrease magnitude of impression. Nonetheless, world development and commodity costs will likely be necessary variables for Australia’s outlook.

Domestically, the current federal election consequence has not considerably altered fiscal coverage expectations. No main contractionary measures are anticipated. The important thing uncertainty is the extent to which personal sector demand will offset a projected decline in public spending. Consumption development has been subdued, and the tempo of restoration stays unsure.

Platform evolution: holding the adviser entrance of thoughts

(By Andy Robertson, Director & Chief Innovation Officer at Chelmer; Jason Entwistle, Director Strategic Growth at Hub24; Stuart Holdsworth, Founding father of Monetary Simplicity; Edwina Maloney, Group Government for Platforms at AMP)

Within the early days, funding platforms have been largely paper-based techniques, centered on dealing with functions, redemptions and reporting. Nonetheless, with advances in know-how and the web, platforms have develop into far more built-in into the workflows of recommendation practices.

- Core objective: productiveness and integration: At their coronary heart, platforms are productiveness instruments. They assist monetary advisors implement recommendation effectively — managing portfolio setup, account creation, buying and selling and settlement. More and more, platforms are specializing in seamless information sharing, automation and consumer expertise to additional improve productiveness.

- Selection and customisation for practices: As many recommendation practices transfer away from giant institutional possession, they usually lack the assets to construct customized tech options. This makes it essential for platforms to supply flexibility and integration choices. Smaller corporations usually want an all-in-one answer to scale back complexity, whereas bigger corporations are inclined to undertake best-of-breed instruments, even when meaning coping with a number of techniques and integration challenges.

- Actuality of multi-platform utilization: Regardless of the best of a single platform answer, most advisors nonetheless use a couple of. The typical is round 2.2 platforms per advisor. That is partly on account of legacy techniques, but additionally displays the necessity to serve completely different consumer segments with tailor-made options. Whereas there’s a push to simplify and consolidate, the business acknowledges that a point of multi-platform use is prone to persist.

- The complexity of integration: Transitioning shoppers between platforms is troublesome. Even inside a so-called “single platform” world, advisors nonetheless use varied instruments—electronic mail, CRMs, AML/KYC techniques—making deep integration vital. Many advisors are overwhelmed by the variety of techniques and screens they have to study to make use of throughout platforms. This inefficiency is a key ache level that wants addressing.

- A brand new wave of know-how: There may be optimism that the following technology of know-how—together with low-code and customisable instruments—will allow practices to construct their very own functions, higher supporting their distinctive workflows. Platforms ought to concentrate on enabling this atmosphere moderately than attempting to construct every little thing themselves.

- Separation of core and add-on capabilities: There’s a rising recognition that the core features of platforms—custody, settlement, execution, compliance—may be separated from value-add instruments like portfolio rebalancing or doc technology. This modular method might permit tech suppliers to higher help one another and construct extra versatile options.

- The shift towards platform consolidation: Whereas multi-platform use stays widespread, the development could also be reversing. A 12 months in the past, 80% of advisors used one platform; immediately, that determine is right down to 16%. Nonetheless, personal possession and the affect of personal fairness—centered on margin and effectivity—could push the business again towards fewer platforms. This development has already performed out within the UK, the place a good portion of recommendation corporations at the moment are personal fairness–owned.

- Innovation in retirement options: Platforms are starting to help extra progressive retirement revenue options, a few of which might ship important advantages for shoppers. Nonetheless, recommendation know-how hasn’t all the time saved tempo, making it arduous to mannequin these methods successfully. There’s a necessity for higher collaboration between platforms and recommendation tech suppliers to shut this hole.

- Lack of true personalisation: Regardless of frequent requires personalisation, many investor portals nonetheless deal with all shoppers the identical. Platforms have but to totally leverage information to tailor experiences in a significant approach. Ideally, platforms ought to permit recommendation corporations to embed their very own model and philosophy—really reflecting their distinctive worth proposition—moderately than counting on generic white-label options.

ETFs vs. LICs: What’s the most suitable choice for traders?

(Nadine Blayney, Co-founder of ausbiz; Jamie Hannah, Deputy Head of Investments & Capital Markets at VanEck; Mark Freeman, Managing Director at AFIC)

- Transparency and construction: ETFs and LICs are each exchange-traded, however ETFs—notably passive ones—provide higher transparency. Buyers can usually view every day holdings, money positions and items excellent, whereas LICs and actively managed funds usually present much less visibility.

- Structural benefits of ETFs: Over current years, ETFs have gained an edge on account of their transparency, truthful worth buying and selling and environment friendly belief construction. This construction requires all revenue and franking credit to be handed instantly by way of to traders, in contrast to LICs, which might retain earnings. Nonetheless, this may result in extra irregular revenue distributions in comparison with the smoother dividends some LICs present.

- Value issues and warning with charges: Whereas each ETFs and LICs can provide low-cost funding choices, traders must be cautious of high-fee ETFs, notably these with efficiency charges or complicated constructions. There’s a rising concern in regards to the proliferation of such merchandise, and new ASX labelling guidelines will assist establish complicated ETFs extra clearly.

- Selecting between ETFs and LICs: LICs could enchantment to income-focused traders looking for constant returns and publicity to a top quality inventory portfolio. They may also be a helpful various to particular person inventory choosing, particularly when buying and selling at a reduction. Reinvestment by way of DRPs (Dividend Reinvestment Plans) was highlighted as a key technique for compounding returns throughout each constructions.

- ETF product development and thematic investing: The ETF market continues to increase quickly, however not all merchandise are created equal. Thematic ETFs may be cyclical, usually attracting traders after peak efficiency. Broad-based ETFs, against this, are usually seen as dependable long-term core holdings.

- Passive vs. energetic efficiency: Passive investing has gained momentum, with passive ETFs usually outperforming actively managed funds over the long run. Citing SPIVA information, a big proportion of energetic managers fail to beat their benchmarks after charges, elevating questions in regards to the worth of high-fee energetic methods.

- Energetic administration nonetheless has a task: Whereas energetic funds have struggled with efficiency and price justification, some nonetheless provide worth—notably these run by expert managers who’re prepared to scale back charges. The important thing problem stays the imbalance between fund efficiency and extreme price extraction.

- Payment pressures throughout the business: Payment compression is a rising development within the ETF business, reflecting broader pressures throughout monetary providers. Advisors and fund managers alike are more and more anticipated to justify their prices.

- Consolidation in LICs: The LIC house has seen elevated consolidation, presumably pushed by managers aiming to develop belongings beneath administration and acquire increased charges. This development displays each strategic realignment and ongoing price pressures throughout the funding business.

- ETFs and LICs as complementary instruments: Moderately than viewing ETFs and LICs as competing merchandise, it was instructed that they will work nicely collectively. Broad ETFs can type the core of a portfolio, whereas LICs and thematic or strategic ETFs can function satellite tv for pc holdings to reinforce diversification.

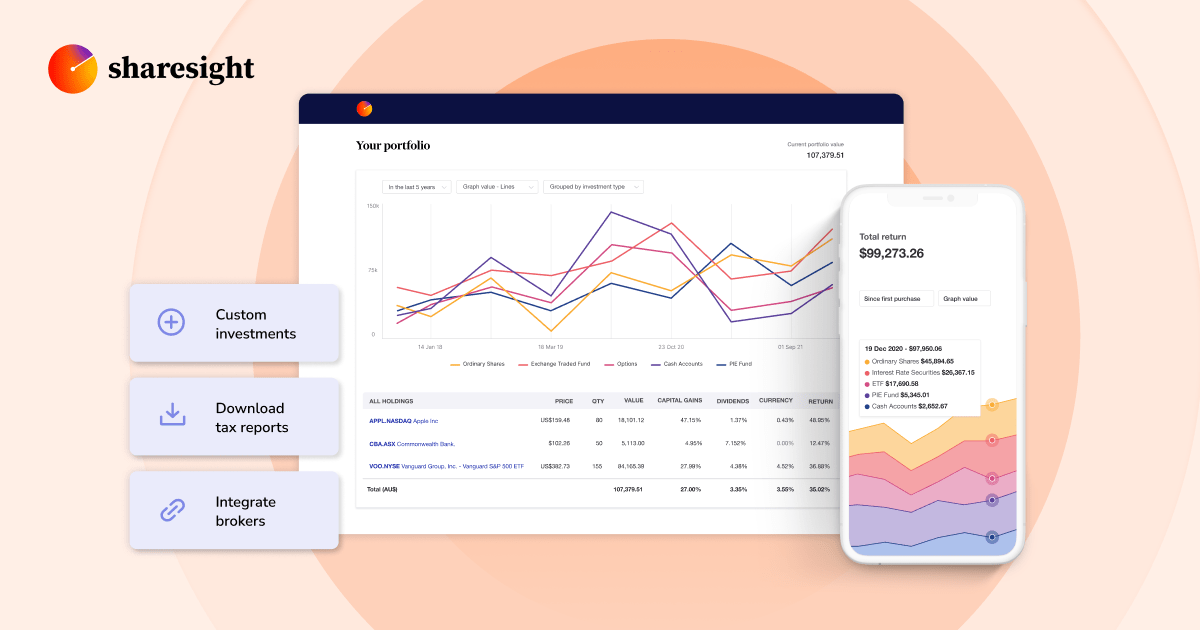

Increase your effectivity with Sharesight

**Staying on prime of business insights is vital — and so is having the correct instruments. By utilizing Sharesight’s portfolio tracker, you possibly can observe a number of consumer portfolios with ease, present higher insights to your shoppers and scale back time spent on tedious admin duties. Start a free trial immediately to get entry to Sharesight’s superior options for monetary professionals and see how Sharesight can enhance your follow. **

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)