Disclaimer: The under article is for informational functions solely and doesn’t represent a particular product advice, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use cheap endeavours to maintain the data up-to-date, we make no illustration that any info is correct or up-to-date. In the event you select to utilize the content material on this article, you achieve this at your personal danger. To the extent permitted by regulation, we don’t assume any duty or legal responsibility arising from or linked together with your use or reliance on the content material on our web site. Please verify together with your adviser or accountant to acquire the proper recommendation in your state of affairs.

Whether or not you’re submitting your personal tax return or working with an accountant, you’re the one accountable for protecting up-to-date and correct information of your share holdings. This may be daunting, particularly if you’re a frequent dealer or obtain dividends from quite a few shares or funds by way of a number of share registries. Fortunately, Sharesight’s on-line portfolio tracker makes it straightforward to remain on high of your information, with computerized dividend monitoring (together with DRPs) and the power to connect digital statements to the holdings in your portfolio. This text will undergo the information you must hold as an investor, plus recommendations on easy methods to keep organised utilizing Sharesight.

The ATO’s record-keeping necessities for buyers

The Australian Taxation Workplace (ATO) could be very clear by way of the records investors are required to keep.

| The information you need to hold | How lengthy you need to hold them |

|---|---|

| Your ‘purchase’ and ‘promote’ statements (also referred to as commerce confirmations or contract notes) |

Preserve these information for 5 years from the date you get rid of your shares |

| Your dividend statements | Preserve these information for 5 years from 31 October or, if you happen to lodge later, for 5 years from the date you lodge your tax return |

You’ll obtain a lot of the information you must hold from:

- The corporate that issued the shares

- The related share registries in your investments

- Your stockbroker or on-line share buying and selling supplier

- Your monetary establishment, if you happen to took out a mortgage to purchase the shares.

Utilizing Sharesight for funding record-keeping

Protecting correct, ATO-compliant funding information is straightforward with Sharesight. To get began, first sign up for a free Sharesight account and add your holdings. When you’ve arrange your portfolio, you may:

1. File the commerce affirmation statements out of your dealer

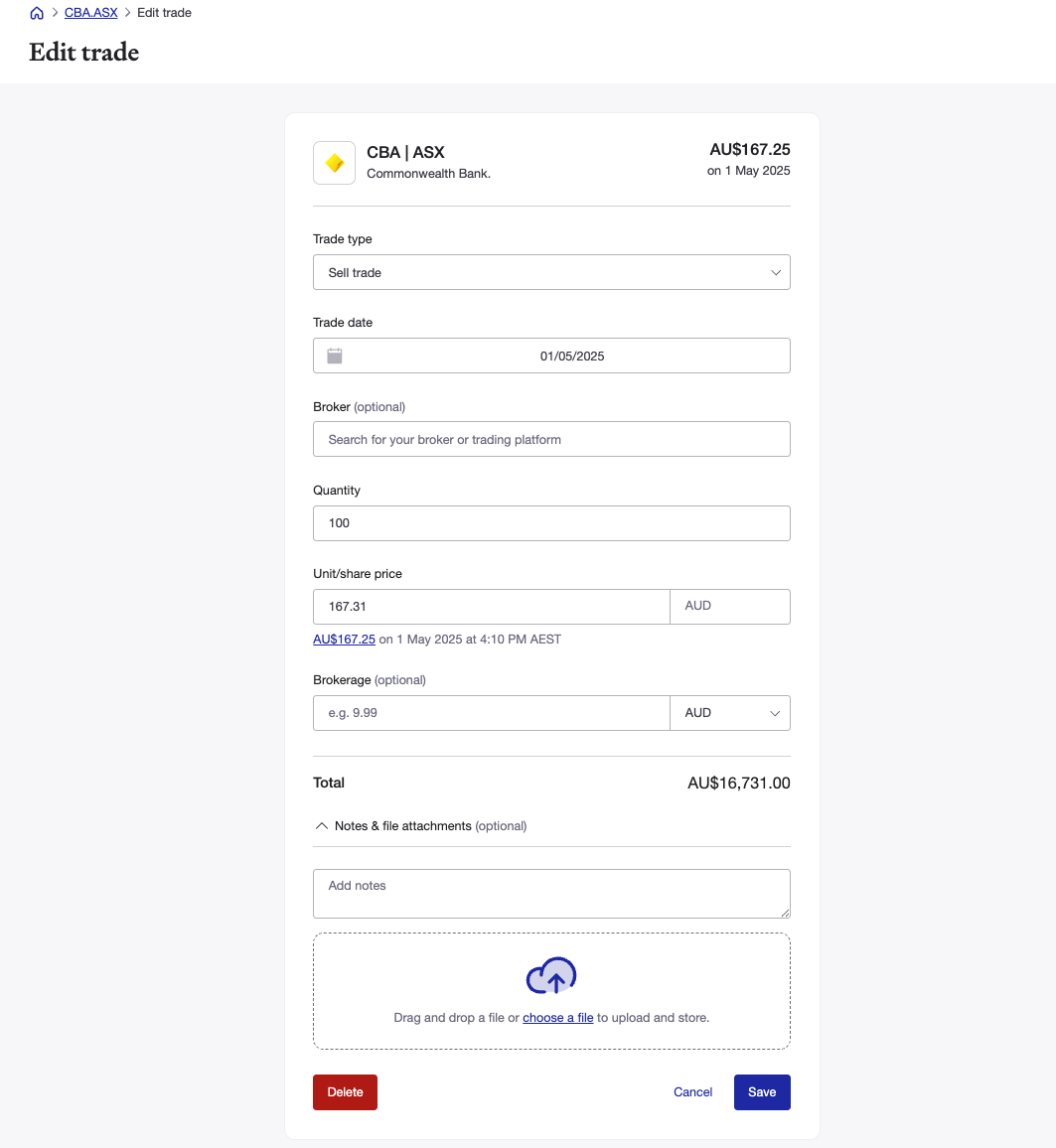

To file your purchase and promote statements, merely connect them to your commerce information in Sharesight:

By clicking into the trades & revenue part in your portfolio, you may edit trades to connect information of the related commerce confirmations.

You possibly can additional automate this step by having your trade confirmation statements forwarded to Sharesight. By enabling this characteristic, your ongoing trades (and commerce affirmation statements) are mechanically recorded in real-time with no extra effort in your half.

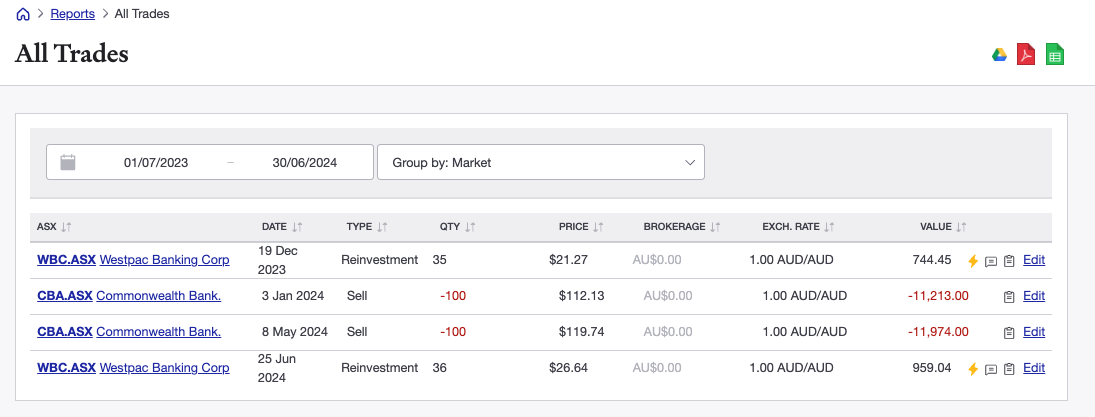

Be aware: To see a listing of all of your trades, merely run the all trades report (pictured under) over the time interval of your selection.

2. File your dividend revenue statements

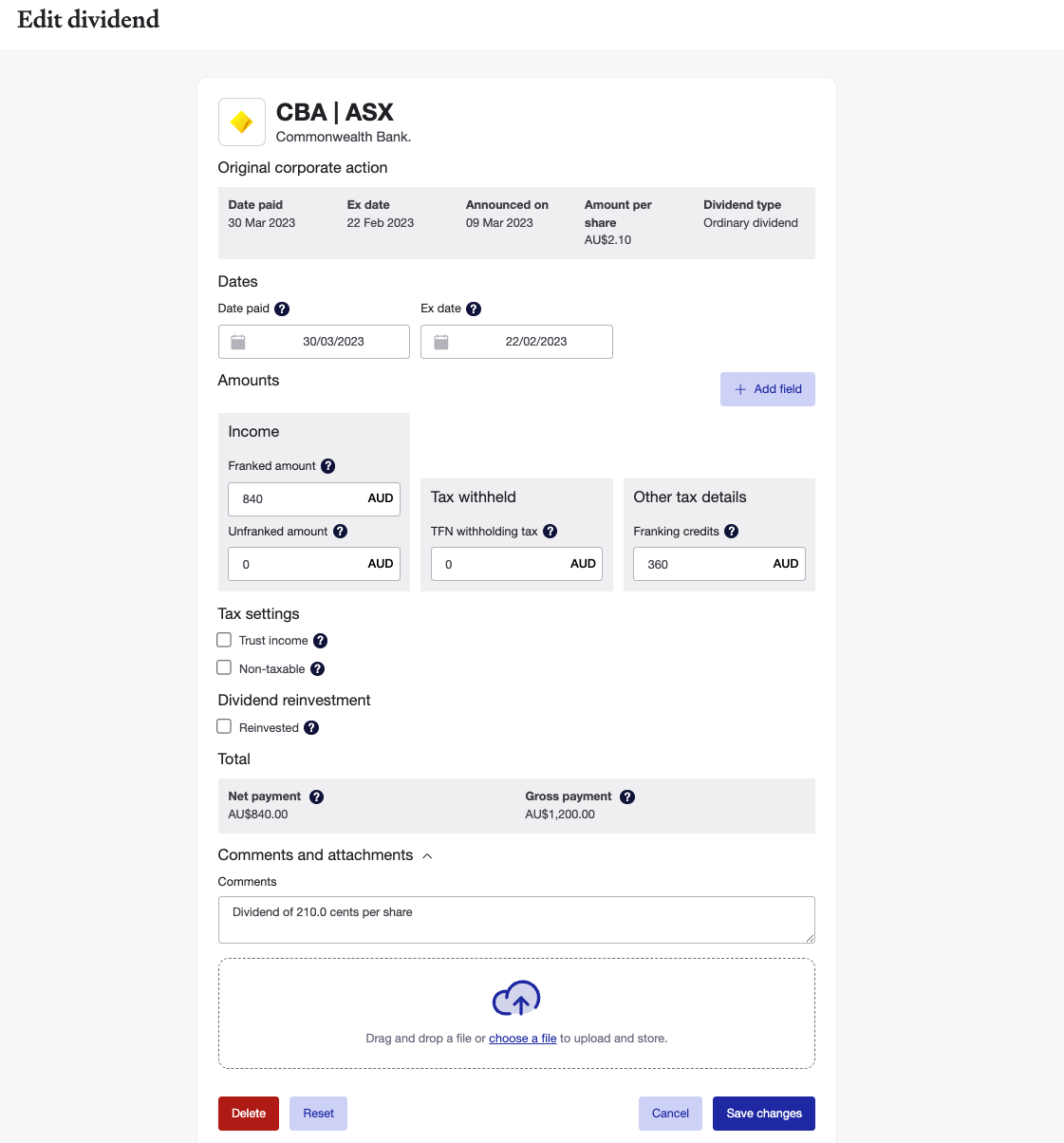

Whenever you add a commerce to Sharesight, the system will mechanically backfill previous dividends and proceed so as to add new ones as they’re introduced. You’ve gotten the power to edit any of the advised information and connect your official dividend statements to the respective dividend entry. This ensures that each one your dividend information are safely saved and organised in a single place (as a substitute of throughout your electronic mail, submitting cupboard, shoebox, and so forth.)

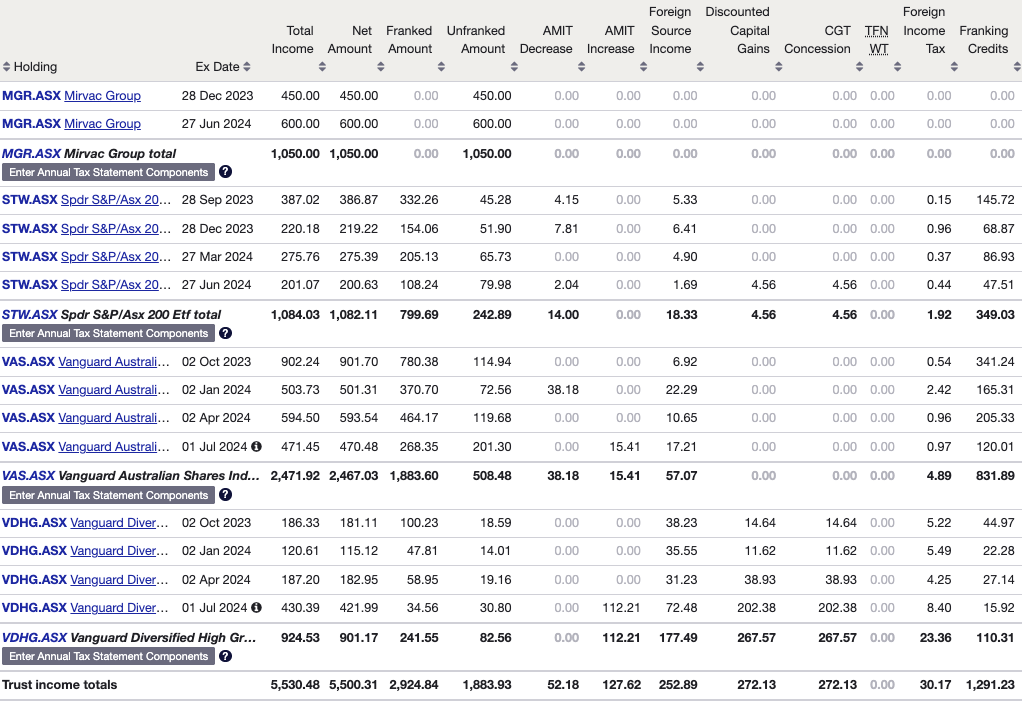

Be aware: You possibly can see all of the dividends you’ve obtained over the time interval of your selection by working the taxable income report (pictured under).

3. Observe the impression of reinvested dividends in your value base

In line with the ATO, if you happen to choose right into a dividend reinvestment plan (DRP), “for tax functions you deal with the transaction as if you had obtained the money dividend after which used it to purchase extra shares”.

This implies the dividend have to be declared as revenue in your tax return, the extra shares will probably be topic to capital positive factors tax (CGT) and the acquisition value of the extra shares is the quantity of the dividend fee used to amass them.

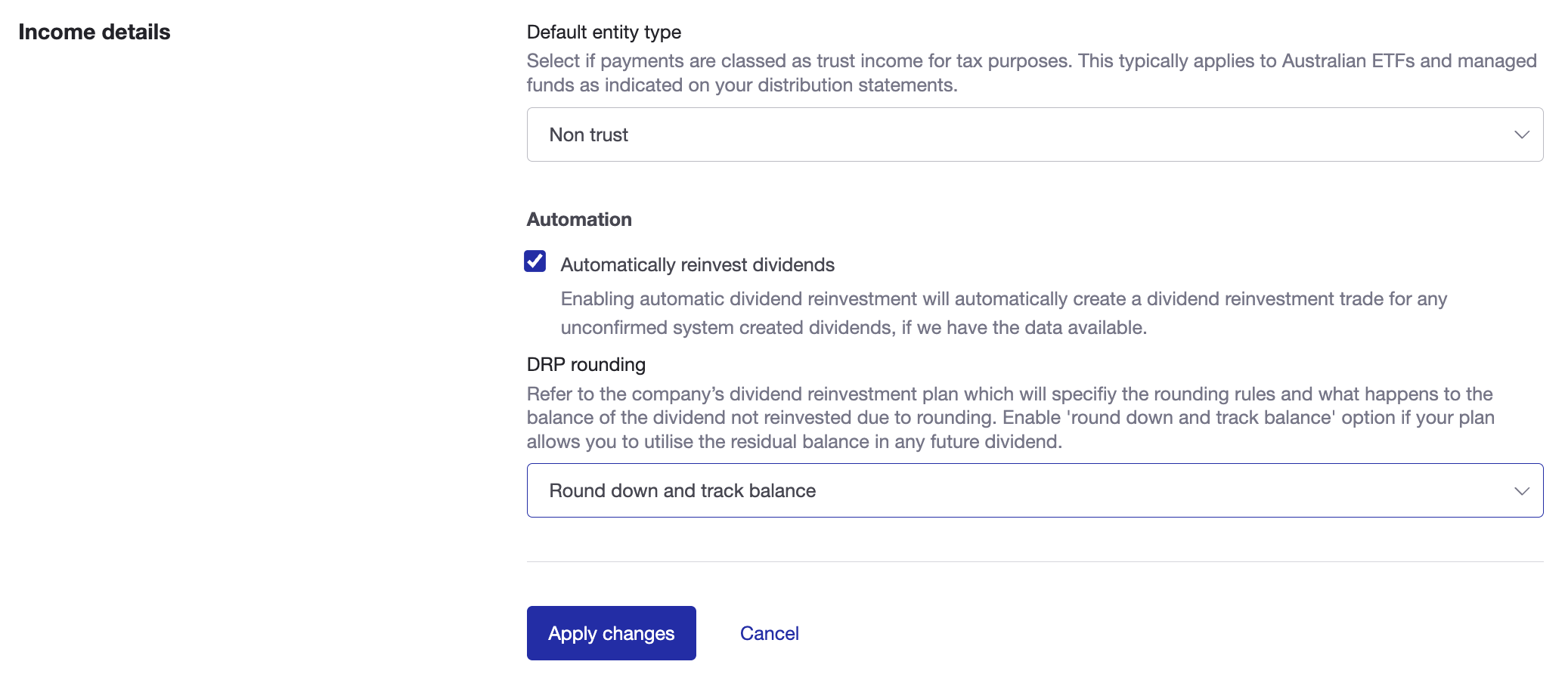

With Sharesight’s portfolio tracker, you’ve the power to mechanically monitor DRPs for any of your Australian or New Zealand holdings by switching on the dividend reinvestment characteristic for that individual holding. For holdings outdoors of ANZ, you may monitor your DRPs by manually coming into a DRP commerce on the appropriate reinvestment value. Both means, you’ll have a whole file of all of your reinvested dividends and their tax implications.

4. Share your information together with your accountant

Sharesight lets you securely share portfolio entry with anybody you select, from members of the family to monetary advisers and accountants. That is particularly helpful at tax time, as your accountant may have all the things they want in a single place — no extra paper chase, shoeboxes stuffed with statements, or misplaced electronic mail attachments.

Observe all of your investments in a single place with Sharesight

Be part of hundreds of Australian buyers already utilizing Sharesight to handle their funding portfolios. With Sharesight you may:

To get began without cost, merely sign up, import your holdings and watch as dividends and costs are mechanically up to date. In the event you determine to improve, you’ll unlock superior options and all the things you must run your tax experiences and achieve unparalleled insights into your portfolio efficiency all year long.

Plus, as an Australian tax resident, it can save you much more by claiming your Sharesight subscription charges in your tax return.1

FURTHER READING

1 In the event you derive revenue from the share market, your Sharesight subscription could also be tax deductible. Verify together with your accountant for particulars.

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)