Disclaimer: The beneath article is for informational functions solely and doesn’t represent a particular product advice, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use cheap endeavours to maintain the knowledge up-to-date, we make no illustration that any data is correct or up-to-date. When you select to utilize the content material on this article, you achieve this at your individual danger. To the extent permitted by legislation, we don’t assume any duty or legal responsibility arising from or linked along with your use or reliance on the content material on our web site. Please test along with your adviser or accountant to acquire the right recommendation in your state of affairs.

Constructed in response to ATO guidelines, Sharesight’s tax reporting instruments save Australian traders each money and time at tax time. Whether or not you file your taxes your self or by way of an accountant, learn on to learn the way Sharesight’s Australia-specific tax options not solely assist you full your tax return, however may prevent money and time.

Listed below are the 5 methods Sharesight helps Australian traders at tax time:

- Australian tax settings

- Australian capital gains tax report

- Unrealised CGT report

- Taxable income report

- Portfolio sharing

Sharesight’s Australian tax options

With all of your funding tax associated information in a single place, and dividends mechanically captured, Sharesight makes tax time a breeze. That is very true for Australian traders, as 4 of the next 5 tax options had been constructed particularly with them in thoughts:

1. Australian tax settings

Buyers with a Sharesight portfolio tax residency set to “Australia” have a selection of the next portfolio tax settings which conform to Australian Taxation Workplace (ATO) tax entities:

-

People / Belief – CGT low cost of fifty %

-

Self Managed Tremendous Fund – CGT low cost of 33⅓ %

-

Firm CGT – low cost of nil.

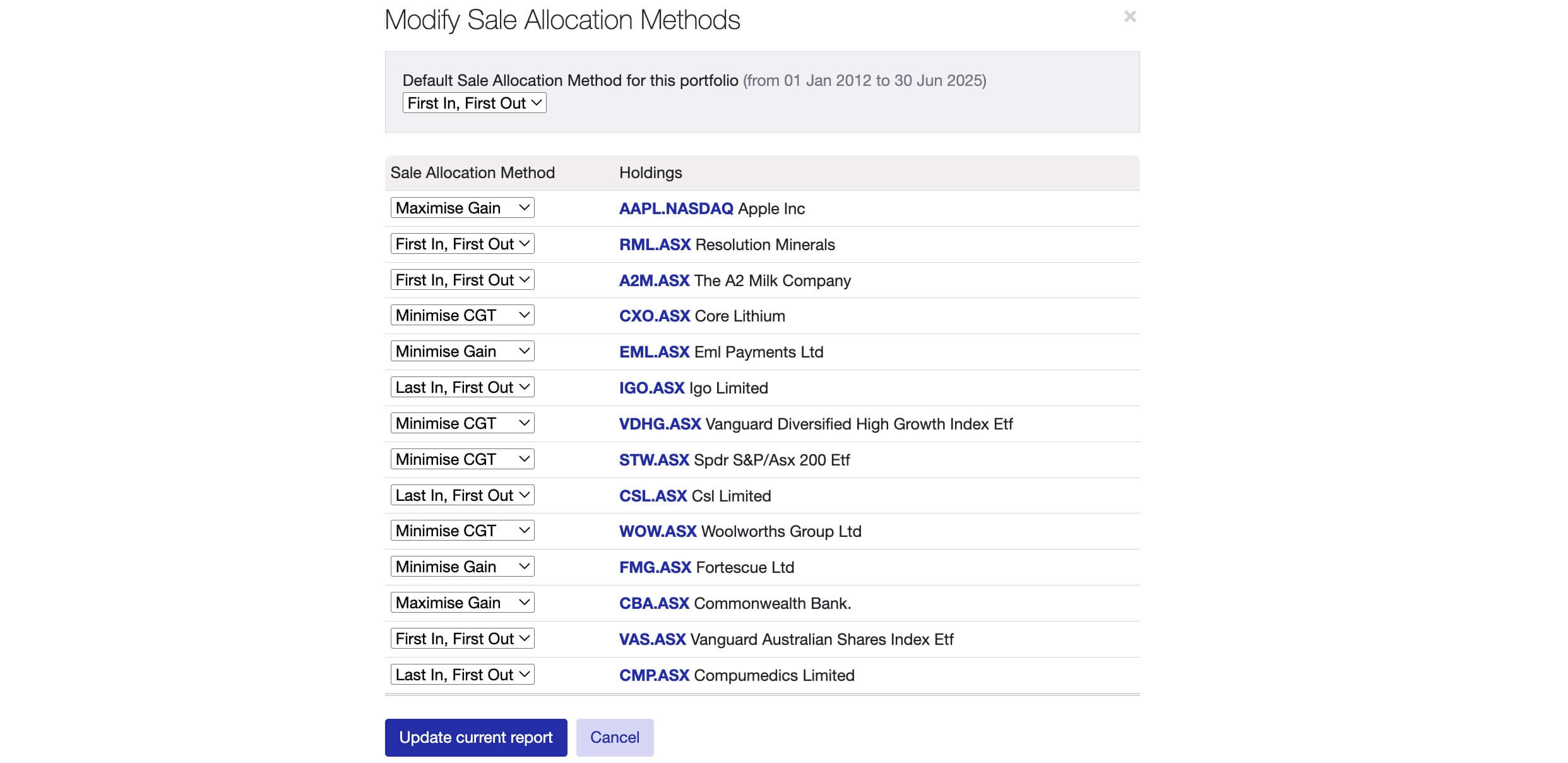

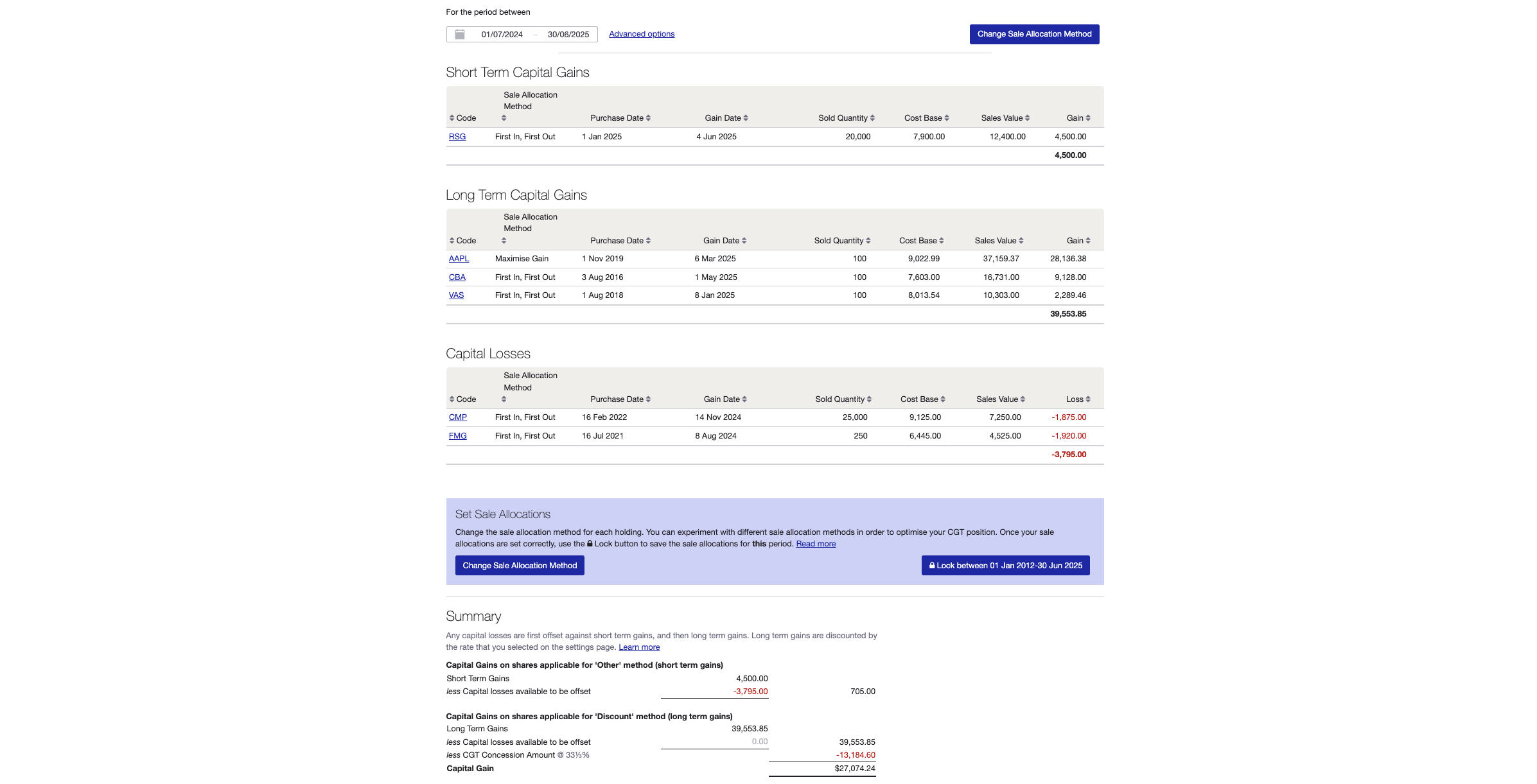

2. Australian capital positive aspects tax report

The Australian capital gains tax report calculates capital positive aspects made on shares as per the Australian Tax Office rules. It means that you can specify totally different sale allocation strategies throughout your entire portfolio and particular person holdings, together with:

-

First In, First Out (FIFO) – Sharesight assumes that you simply promote your longest held shares first.

-

Final In, First Out (LIFO) – Sharesight assumes that you simply promote your most lately bought shares first.

-

Minimise Achieve – Sharesight assumes that you simply promote shares with the very best buy worth first.

-

Maximise Achieve – Sharesight assumes that you simply promote shares with the bottom buy worth first.

-

Minimise CGT – Sharesight assumes that you simply promote shares that can end result within the lowest capital positive aspects tax first. This technique is extra refined than the ‘Minimise capital achieve’ technique as a result of it takes into consideration the Australian CGT discounting guidelines.

It’s possible you’ll run the capital positive aspects tax report over any interval with the intention to see:

-

The CGT place for all of your holdings bought inside the interval

-

Your CGT positive aspects damaged up into quick and long run, in addition to losses and discounted capital achieve distributions

-

A abstract of the quick and long run positive aspects and losses, plus any capital achieve or claimable loss.

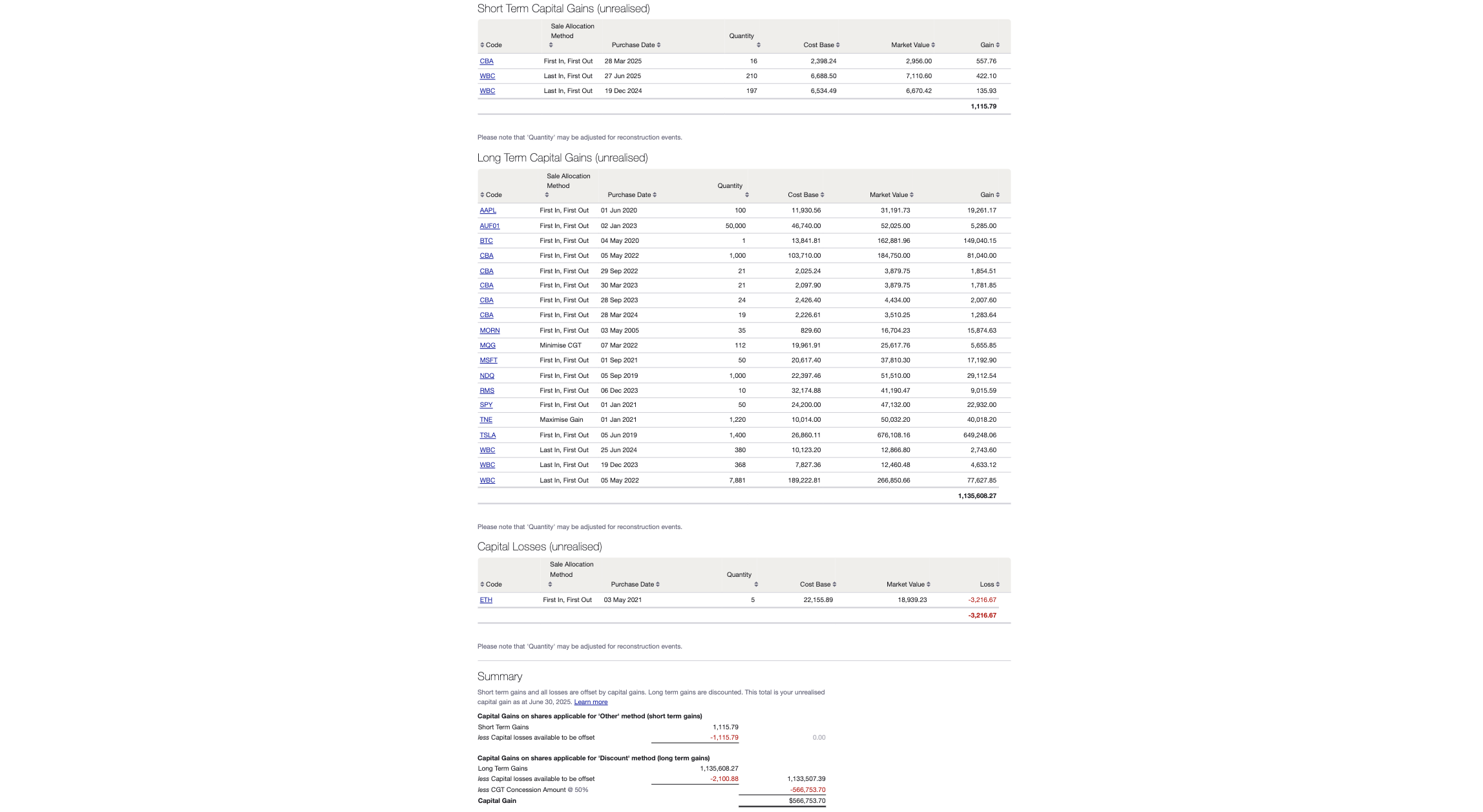

3. Unrealised CGT report

When you’ve incurred some losses this yr, the unrealised CGT report helps you resolve whether or not a tax loss selling technique may help you offset your positive aspects earlier than the top of the tax yr.

The unrealised CGT report:

-

Shows the CGT place for all of your holdings which aren’t but bought

-

Breaks up the CGT positive aspects into quick and long-term, and exhibits your losses as properly

-

Lets you specify the sale allocation technique on the general portfolio and particular person holding stage to find out your optimum place

-

Fashions the taxable revenue that might come up if the shares had been bought on the report date.

Sharesight’s unrealised CGT report makes it simple for traders to mannequin totally different tax loss promoting eventualities.

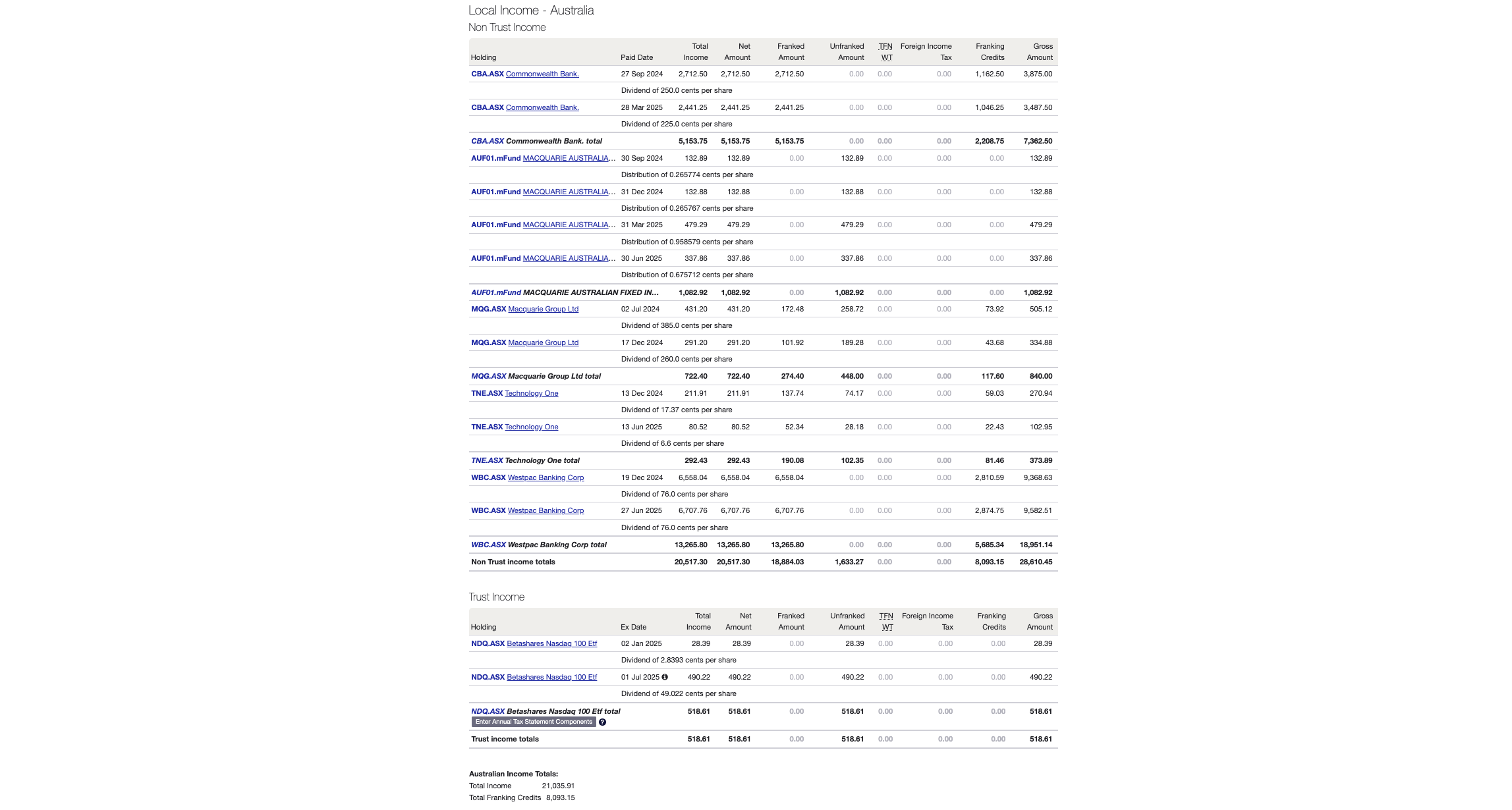

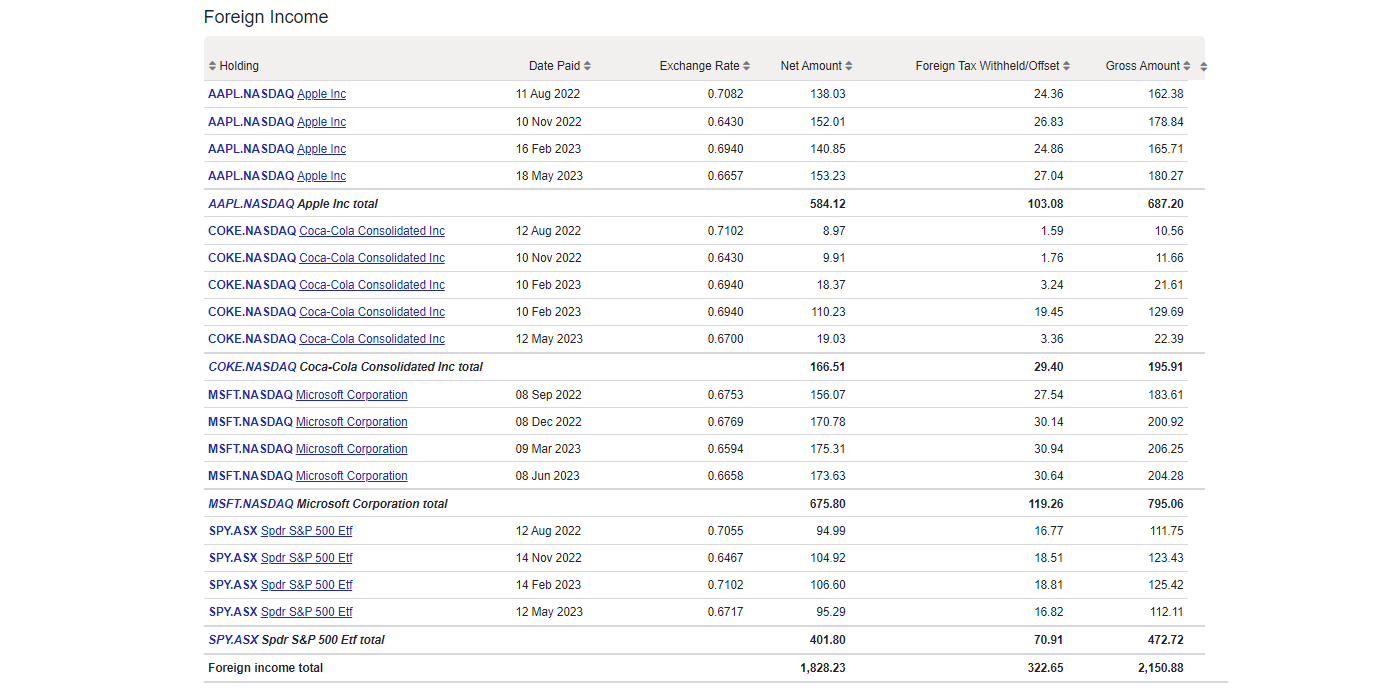

4. Taxable revenue report

The taxable income report can also be very helpful at tax time because it breaks down all dividends over any time interval, organised by native/abroad revenue and separates out withholding tax and imputation credit from the online dividend.

The taxable revenue report breaks down taxable revenue into native revenue (belief and non-trust) and overseas revenue.

The report additionally gives discipline references to the related sections on the Australian Revenue Tax Return for People and Revenue Tax Return for People (supplementary part), in addition to the totals required for the Revenue Tax Return based mostly on non-trust and belief revenue. This may go a good distance in serving to traders to file their tax returns.

5. Portfolio sharing

One other important tax time characteristic is the power to share your portfolio. Somewhat than printing out and forwarding your Sharesight tax reviews, you’ll be able to securely share portfolio entry straight along with your accountant and/or monetary advisor. With all of your portfolio information in a single place, they’ll have every thing they should put together your tax paperwork. Obtainable on all Sharesight plans, portfolio sharing ensures everybody’s on the identical web page and specializing in what actually issues – not simply at tax time however all through the entire yr.

Merely the very best portfolio tracker for Australian traders

Be part of hundreds of Australian traders already utilizing Sharesight to handle their funding portfolios. With Sharesight you’ll be able to:

To get began for FREE, merely sign up, import your holdings and watch as dividends and costs are mechanically up to date. When you resolve to improve, you’ll unlock superior options and every thing it’s worthwhile to run your tax reviews and achieve unparalleled insights into your portfolio efficiency all year long.

Plus, as an Australian tax resident, it can save you much more by claiming your Sharesight subscription charges in your tax return.1

FURTHER READING

1 When you derive revenue from the share market, your Sharesight subscription could also be tax deductible. Test along with your accountant for particulars.

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)