Disclaimer: This text is for informational functions solely and doesn’t represent a selected product suggestion, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use affordable endeavours to maintain the knowledge up-to-date, we make no illustration that any info is correct or up-to-date. In the event you select to utilize the content material on this article, you accomplish that at your individual threat. To the extent permitted by regulation, we don’t assume any duty or legal responsibility arising from or linked along with your use or reliance on the content material on our web site. Please verify along with your adviser or accountant to acquire the proper recommendation in your scenario.

ETF overlap is a hidden threat that may quietly sabotage your portfolio’s diversification technique — no matter how fastidiously you select your investments. Whilst you could also be investing in exchange-traded funds (ETFs) to attain diversification, it’s simple to unintentionally spend money on overlapping funds, which may result in an over-concentration in particular shares or sectors, undermining the very purpose of spreading threat.

This focus threat arises as a result of the seemingly distinct ETFs are, in actual fact, doubling and even tripling down on the identical underlying belongings. You would possibly consider your ETFs are diversified throughout varied market segments, but when the underlying holdings of your chosen ETFs are extremely correlated, your portfolio’s efficiency turns into closely depending on the fortunes of a restricted variety of corporations.

On this article, we’ll dive deeper into ETF overlap and focus threat, stroll by a real-world instance of ETF overlap, and present how Sharesight’s publicity report helps you establish and keep away from hidden overlap threat.

Understanding overlap and focus

Focus threat is the hazard of loss ensuing from having a big portion of your investments in a single asset, sector or geographical area. When that individual space performs poorly, a concentrated portfolio will undergo disproportionately massive losses. ETF overlap contributes on to this threat.

To realize a greater understanding, think about a state of affairs during which you maintain each an S&P 500 ETF and a technology-focused ETF. Whereas these might look like separate investments, the S&P 500 is market-cap weighted, which means massive expertise corporations already represent a good portion of its holdings. By including a expertise ETF to your portfolio, you’d be amplifying your publicity to those identical tech giants, comparable to Apple, Microsoft and NVIDIA. A downturn within the tech sector would then have a extra extreme impression in your portfolio than you may need anticipated.

A sensible instance of elevated focus

Right here’s one other hypothetical state of affairs involving three well-liked, real-world ETFs:

- iShares Core S&P 500 ETF (IVV): Tracks the S&P 500 index

- Invesco QQQ Belief (QQQ): Tracks the Nasdaq-100 Index, which is closely weighted in the direction of expertise and progress shares

- Vanguard Progress ETF (VUG): Invests in large-cap U.S. progress shares.

Holding all three of those ETFs, you would possibly consider you’ve gotten a diversified portfolio spanning the broader market, expertise leaders and growth-oriented companies. Nevertheless, a more in-depth take a look at their high holdings reveals important overlap and publicity to Huge Tech.

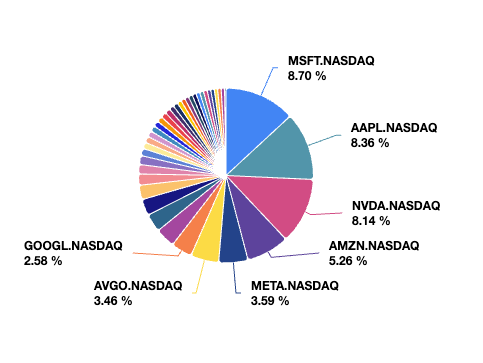

Publicity report run on a “don’t group” foundation on Sharesight.

In the event you had an equal allocation to those three ETFs, you’d discover that your precise publicity to Huge Tech is much higher than the person ETF weightings counsel. This hidden focus means your portfolio is much less diversified and extra inclined to dangers affecting the large-cap progress and expertise sectors.

The answer: X-ray into underlying holdings with Sharesight’s publicity report

Manually checking the holdings of every ETF may be time consuming and complicated, particularly as your portfolio grows. That is the place a devoted portfolio monitoring device like Sharesight turns into invaluable. Sharesight is designed to present you true visibility into your investments, and our exposure report is the right answer for diagnosing ETF overlap and focus threat.

As an alternative of simply displaying you a listing of the ETFs you personal, the publicity report goes deeper, offering an in depth breakdown of your direct holdings and any underlying holdings inside ETFs, revealing the shares, sectors and nations you’re uncovered to throughout your total portfolio.

The report provides you the power to analyse your portfolio’s publicity throughout a number of components, together with:

- Market: See your allocation to completely different inventory exchanges

- Sector: Uncover if you’re unintentionally obese in sure sectors

- Nation: Perceive your geographic diversification

- Particular person holdings: Get a listing of each single underlying firm you personal and its whole weighting in your portfolio.

By operating the publicity report, the summary drawback of ETF overlap turns into a transparent, data-driven perception. It provides you certainty, together with all the info that you must make knowledgeable selections.

Managing threat with readability

As soon as Sharesight has helped you establish unintended concentrations, you’ll be able to take motion. You would possibly determine to promote one of many overlapping ETFs and substitute it with a fund that provides real diversification, comparable to a small-cap, worldwide or bond ETF.

A sure diploma of overlap could also be intentional. For instance, you probably have robust conviction within the long-term prospects of a selected sector, you could select to obese it as a part of your technique. The important thing distinction is that through the use of a device like Sharesight, this focus turns into a acutely aware and deliberate a part of your funding technique moderately than an accident of ignorance.

In conclusion, whereas ETFs are highly effective instruments, you have to be vigilant concerning the potential for overlap. By leveraging the highly effective analytics of Sharesight’s publicity report, you’ll be able to look by, perceive your portfolio’s true composition, and guarantee you take on the correct amount of threat in your monetary targets.

Be a part of a whole lot of hundreds of traders world wide utilizing Sharesight to robotically observe their funding efficiency and tax, and make smarter investing selections. With Sharesight you’ll be able to:

- Monitor all your investments in a single place, together with shares, ETFs, mutual/managed funds, property and even cryptocurrency

- Mechanically observe your dividend and distribution income from shares, ETFs and mutual/managed funds

- Run highly effective experiences constructed for traders, together with performance, diversity, contribution analysis, future income, exposure, risk, multi-period and multi-currency valuation

- See the true image of your funding efficiency, together with the impression of brokerage charges, dividends, and capital positive aspects with Sharesight’s annualised performance calculation methodology

FURTHER READING

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)