Disclaimer: This text is for informational functions solely and doesn’t represent a selected product advice, or taxation or monetary recommendation and shouldn’t be relied upon as such. Whereas we use affordable endeavours to maintain the data up-to-date, we make no illustration that any data is correct or up-to-date. When you select to utilize the content material on this article, you achieve this at your personal threat. To the extent permitted by regulation, we don’t assume any duty or legal responsibility arising from or related along with your use or reliance on the content material on our web site. Please examine along with your adviser or accountant to acquire the right recommendation to your state of affairs.

With the ever-growing variety of stockbrokers accessible to UK traders, many are left questioning which is the most effective dealer to go well with their wants. Priorities differ relying on the person investor; for instance, are they a frequent dealer or extra of a long-term investor? Do they like shares of ETFs? And do they make investments regionally or globally? With a few of these questions in thoughts, we check out the most well-liked brokers amongst British Sharesight customers in April 2024 – March 2025.

What drove UK investor behaviour in 2024-2025

Between March 2024 and April 2025, UK markets confirmed resilience regardless of ongoing world financial uncertainty. The FTSE 100 and FTSE 250 each delivered robust performances, outpacing main worldwide indices and renewing investor curiosity in UK property. This momentum was supported by a stronger pound, easing power costs and rising expectations of rate of interest cuts from the Financial institution of England as inflation pressures started to subside.

Investor sentiment progressively improved because the financial system confirmed indicators of stability, with modest development in each GDP and retail exercise. The UK’s service-heavy financial system and comparatively low export publicity additionally helped cushion the affect of world commerce disruptions. General, the interval was outlined by cautious optimism, with favorable financial indicators and a extra supportive coverage surroundings contributing to renewed confidence in UK markets.

Hottest brokers for UK traders

Taking a look at the most well-liked dealer amongst our UK userbase throughout this era, Trading212 was the clear winner, adopted by Interactive Investor and Interactive Brokers.

What makes Trading212 such a well-liked selection for UK traders? Trading212 presents commission-free buying and selling, plus entry to shares and ETFs on a variety of main world

exchanges. It additionally permits traders to open a Shares and Shares ISA account to take a position tax-free. For the traders utilizing each Trading212 and Sharesight, it’s simple to import Trading212 trades to a Sharesight portfolio utilizing a spreadsheet or automated commerce affirmation e-mail forwarding, serving to them keep on prime of their portfolio with minimal effort.

Interactive Investor got here in second place, probably because of its flat-fee pricing, broad entry to UK and worldwide markets, and help for ISA, SIPP and Junior ISA accounts. For traders utilizing Sharesight, it’s easy to maintain their portfolio updated by importing a spreadsheet of trades or manually forwarding commerce affirmation emails, making Interactive Investor one other handy selection for many who need highly effective portfolio monitoring alongside their investing.

Prime trades for UK traders

As may be seen from the chart beneath, UK traders’ prime commerce over the April 2024 – March 2025 interval was NVIDIA (NASDAQ: NVDA). This US tech firm skilled excessive volatility over the interval, together with record-breaking highs and temporary surges in valuation, in addition to sharp sell-offs pushed by market sentiment and AI sector issues. The highest trades had been adopted by Microsoft (NASDAQ: MSFT), which confronted rising issues from shareholders because it made main AI investments however struggled with slowing cloud development, rising prices and market pressures. Coming in third place, Apple (NASDAQ: AAPL) had blended outcomes, with temporary share worth highs pushed by AI hype, however ongoing struggles with declining iPhone demand and regulatory hurdles overseas.

Hottest nations for UK traders

Unsurprisingly, the UK topped the listing as the most well-liked vacation spot for UK traders, reaffirming the house bias typically seen amongst retail and self-directed traders. The US got here in as a robust second selection, reflecting its dominant market efficiency and the worldwide enchantment of main American corporations. Broader Europe and Germany adopted, rounding out the highest areas of curiosity. This pattern aligns with expectations, given the energy and stability of US markets, mixed with the truth that most UK brokers provide quick access to UK, US and key European exchanges. These preferences counsel that UK traders are taking a sensible method, specializing in acquainted, well-performing markets with simple accessibility.

Hottest dealer for world trades

Taking a look at UK traders’ hottest brokers for worldwide trades, Trading212 was additionally a transparent winner. That is additionally not shocking, given the truth that it offers traders entry to commission-free trades on shares and ETFs from main US and European exchanges. The dealer’s fractional shares and low minimal funding necessities additionally make it particularly interesting to newer traders who wish to diversify past the UK market with out excessive prices or difficult processes.

Interactive Brokers got here in second place, probably because of its low-cost buying and selling charges and in depth worldwide market help. The dealer presents entry to over 150 markets in additional than 30 nations, all from a single multi-currency account. With aggressive pricing and help for tax-efficient accounts like ISAs and SIPPs, it appeals to each skilled traders and people trying to construct globally diversified portfolios.

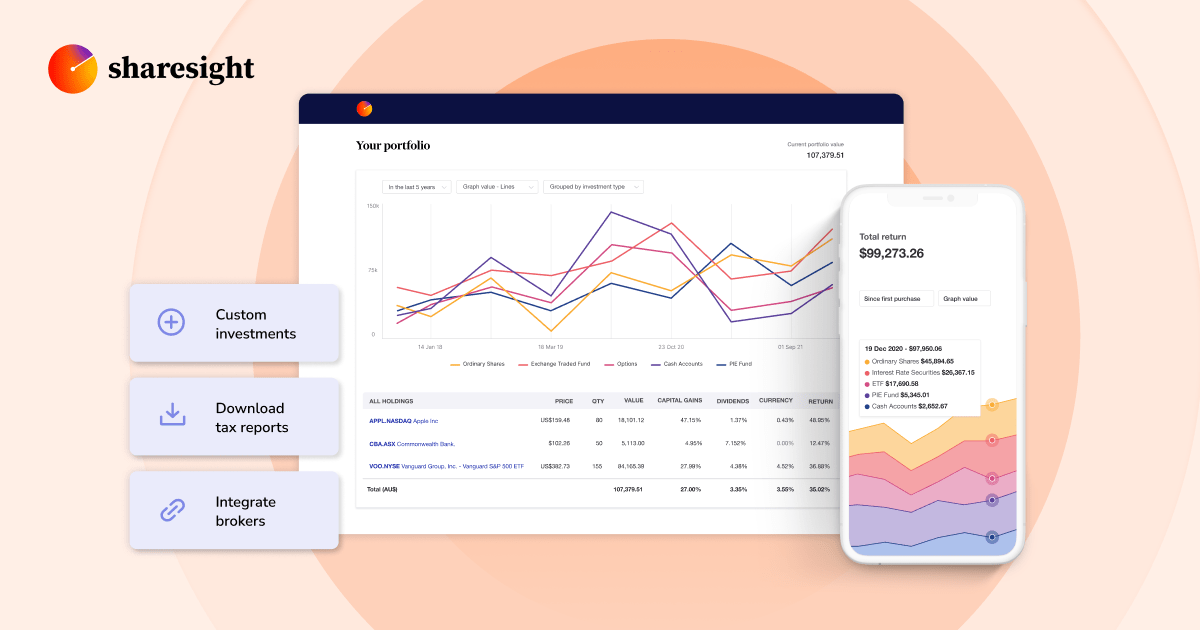

Monitor all of your investments in a single place with Sharesight

Hundreds of traders like you’re already utilizing Sharesight to trace the efficiency of their UK investments — together with the remainder of their portfolio — multi function place. When you’re not already utilizing Sharesight, what are you ready for? Sign up and:

- Monitor all your investments in a single place, together with world shares, ETFs, mutual/managed funds, property and even cryptocurrency

- Robotically monitor your dividend and distribution income from shares, ETFs and mutual/managed funds

- Run highly effective reviews constructed for traders, together with performance, portfolio diversity, contribution analysis, future income, exposure, drawdown risk, multi-period and multi-currency valuation

- See the true image of your funding efficiency, together with the affect of brokerage charges, dividends, and capital beneficial properties with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get began monitoring your funding efficiency (and tax) at the moment.

FURTHER READING

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)