The insurance coverage {industry} is rife with competitors. One of many greatest industries on a world scale, its estimated world market worth was almost $5.5 trillion in 2021, and that quantity has grown since.

So how can insurance coverage brokers and brokers stand out in such a crowded market? One technique to differentiate your self is to develop and nurture good buyer relationships.

You are able to do this with the assistance of the best workflows and instruments, and a CRM is likely one of the finest instruments for this. This software program handles a wide range of duties in help of insurance coverage brokers’ efforts to construct long-term connections with their clients, making the method simple to handle and preserve over time.

On this article, we take an in-depth take a look at CRM software program for insurance coverage, beginning with what it’s and what benefits it affords. Then we dive into the other ways you should utilize CRMs within the insurance coverage {industry}, adopted by strategies for main CRM insurance coverage software program.

The fundamentals and advantages of an insurance coverage CRM

A buyer relationship administration (CRM) instrument is a software program resolution insurance coverage brokers and brokers can use to simplify many customer-related workflows, equivalent to lead administration, gross sales engagement, information entry, and extra.

Put merely, a CRM for insurance coverage saves you time by dealing with your caseload extra successfully, and it permits you to have extra significant buyer interactions — each of which improve your probabilities for achievement.

“A CRM system is a robust instrument for insurance coverage firms that may assist them improve their customer support, streamline operations, and improve gross sales,” says Evan Tunis, president of Florida Healthcare Insurance. “By using a CRM software program, insurance coverage firms can have entry to buyer information in a single place, permitting them to higher perceive their clients’ wants, present higher personalization, and improve buyer satisfaction.”

The numerous benefits a CRM offers embrace

- Consolidated information: A CRM collects and shops details about your prospects and clients multi functional place, from their contact data to their final engagement with a gross sales rep. This lets you shortly be taught a buyer’s total historical past with the intention to serve them extra successfully.

- Collaborative processes: Typically, a number of persons are concerned in serving a buyer or engaged on a case. A CRM facilitates this collaboration by making all the mandatory data accessible for the best folks. CRMs additionally make it simple to import and export data in addition to share it between departments and workplaces.

- Workflow automation: It’s simple to automate low-level duties, equivalent to sending follow-up or reminder emails, with a CRM. This enables you and your workforce to deal with higher-priority duties.

- World-class safety: Your leads and clients don’t need their confidential data within the mistaken arms, which is why many CRMs have enterprise-level security measures in addition to role-based entry options.

- In-depth evaluation: CRMs are information treasure troves that you should utilize to grasp developments, patterns, and anomalies in your prospect and buyer base. This will help you make selections about future workflows or insurance coverage insurance policies.

Methods to make use of a CRM in insurance coverage

To reap the above advantages, it’s essential to grasp your CRM’s numerous options and functions so you’ll be able to take full benefit of them.

“A CRM can be utilized in many various methods by insurance coverage firms,” says Tunis. “For instance, they’ll use the system to higher handle leads and determine potential clients. The information collected from a CRM additionally allows insurance coverage firms to trace buyer historical past and preferences, create focused campaigns and commercials, assess buyer churn fee, and perceive buyer shopping for behaviors.

“Moreover, a CRM system permits insurance coverage firms to automate companies, equivalent to reminders for coverage renewals and funds. This enhances customer support whereas additionally saving time and sources.”

The numerous completely different functions for a CRM in insurance coverage embrace

- Lead seize: You possibly can combine a CRM together with your insurance coverage firm web site with the intention to seize lead contact data and be taught extra about what services or products they’re excited by. Some CRMs even have lead prioritization options so you’ll be able to robotically assign significance to every lead relying on their demographics or habits.

- Buyer segmentation: With a CRM, you’ll be able to categorize clients primarily based on completely different standards, equivalent to shopping for stage or demographics, with the intention to higher cater to them with advertising campaigns and gross sales affords.

- Staff administration: You need to use a CRM to assign leads and clients to completely different folks in your workforce in addition to observe up with workforce members for particular duties and initiatives. Some CRMs may also automate lead distribution to make sure all reps have the best load.

- Gross sales forecasting: You need to use a CRM to find out what number of prospects are within the pipeline, after they’re anticipated to shut, and the place your gross sales gaps are. This fashion, insurance coverage personnel can plan successfully for busy durations, decide budgets, and even innovate new companies to draw clients.

- Report technology: Many CRMs include report technology options so you’ll be able to glean insights from lead and buyer data. Figuring out patterns and developments on this information will help you make long-term enterprise selections.

- Fee monitoring: Within the insurance coverage {industry}, fee is a big a part of compensation. A CRM will help the corporate preserve observe of gross sales by every consultant to precisely calculate commissions. Many CRMs have accounting modules and gross sales leaderboards.

Main insurance coverage CRMs to take a look at

There are many CRMs available on the market, however which of them are finest for the insurance coverage {industry}?

“When deciding on a CRM system for his or her firm, insurance coverage brokers ought to search for one that gives complete options to assist them higher perceive and serve their clients,” says Tunis. “It’s essential to decide on a system with sturdy buyer information administration capabilities to allow them to simply entry and analyze buyer data.”

Take a look at these 5 main choices.

1. Jotform

Jotform is a well-liked survey maker that you should utilize as a CRM in your insurance coverage enterprise. Simply use the various insurance form templates to seize data from leads and clients and build your custom CRM using a table template.

Jotform is intuitive and simple to make use of, and also you don’t have to know find out how to code with the intention to customise your CRM. Together with your Jotform CRM, you’ll be able to assign results in reps, observe lead and buyer engagements, embed types in your web site, and far more.

Jotform is accessible without spending a dime, and it affords 4 tiers of paid plans beginning at $34 monthly.

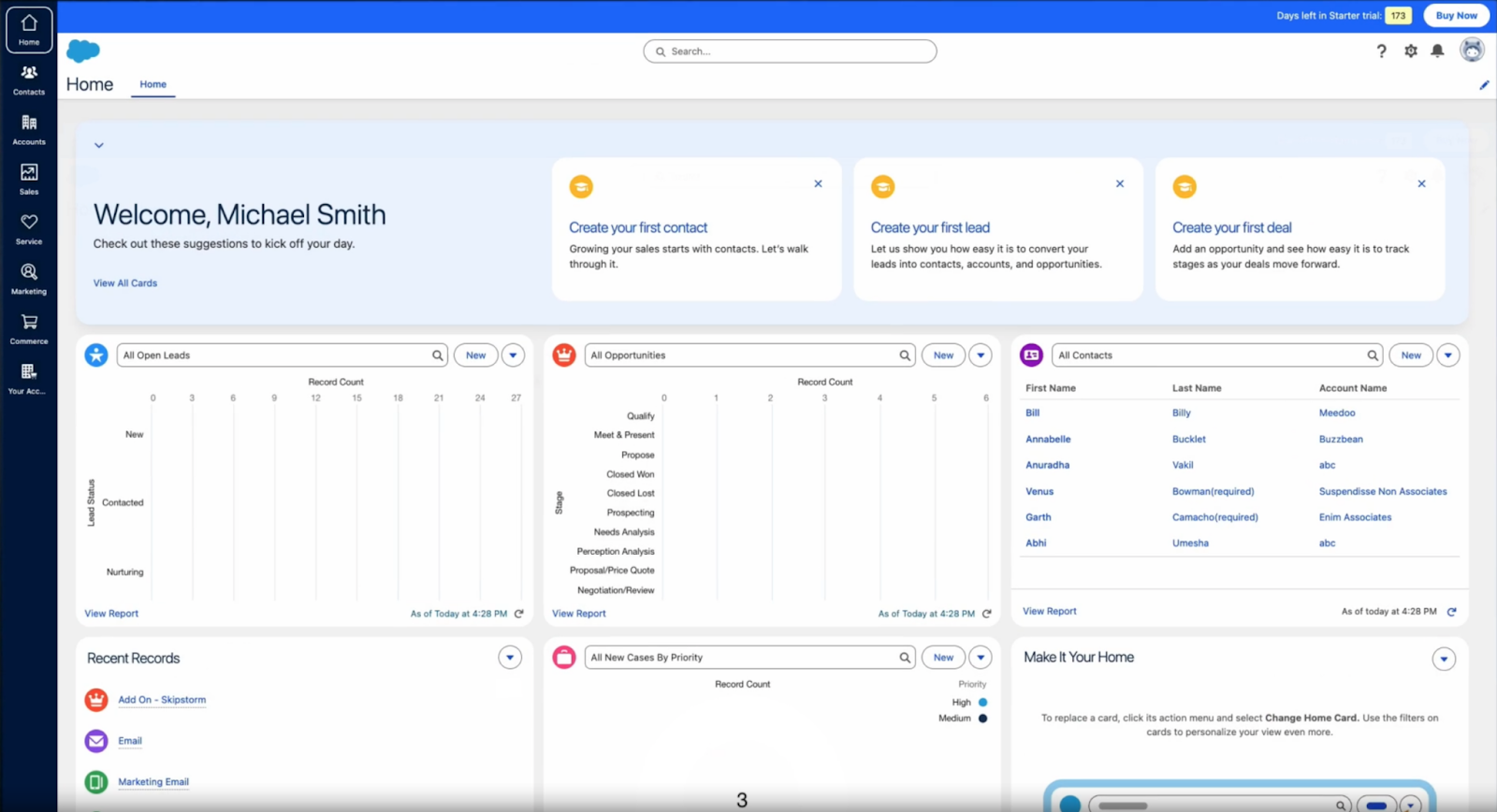

2. Salesforce

Salesforce is a CRM instrument that gives particular options for the insurance coverage {industry}. With Salesforce, you’ll be able to supply self-service instruments to your coverage holders, make the most of the total Salesforce equipment of promoting and gross sales sources, and make detailed logs of agent-customer interactions. Plus, Salesforce affords completely different options for several types of insurance coverage firms, equivalent to property and casualty, group advantages, and life and annuity.

Salesforce affords a number of CRM packages and merchandise. Contact Salesforce for pricing particulars.

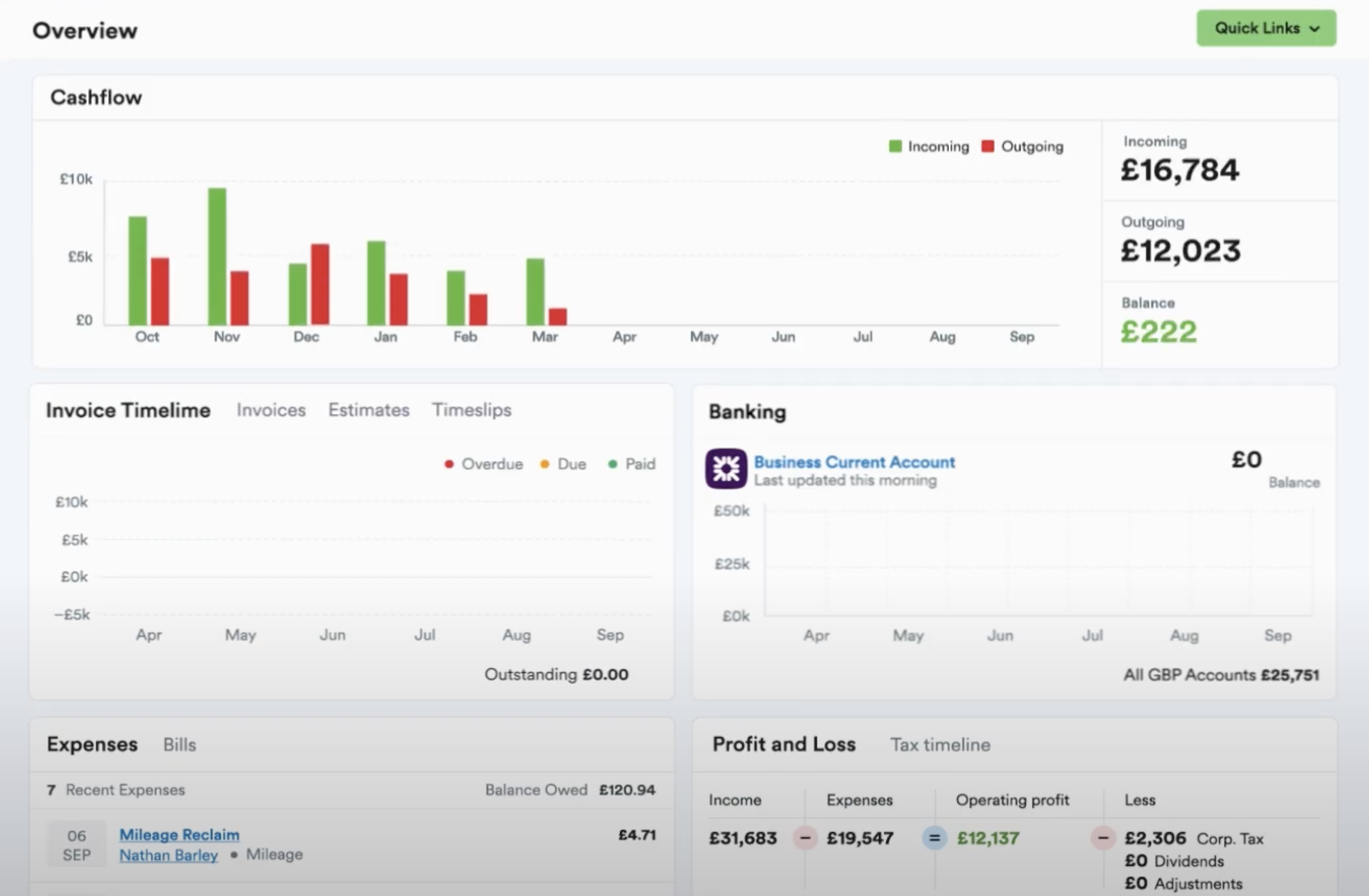

3. FreeAgent

FreeAgent is a CRM and workforce administration platform that insurance coverage companies can use to make sure every agent stays on observe with their caseload. It affords gross sales pipeline visibility, buyer administration and lead administration instruments, lead scoring means, and gross sales forecasting for insurance coverage insurance policies. FreeAgent can consolidate exercise over e mail, cellphone, textual content, conferences, and extra.

FreeAgent affords a free trial and three tiers of paid plans beginning at $35 monthly.

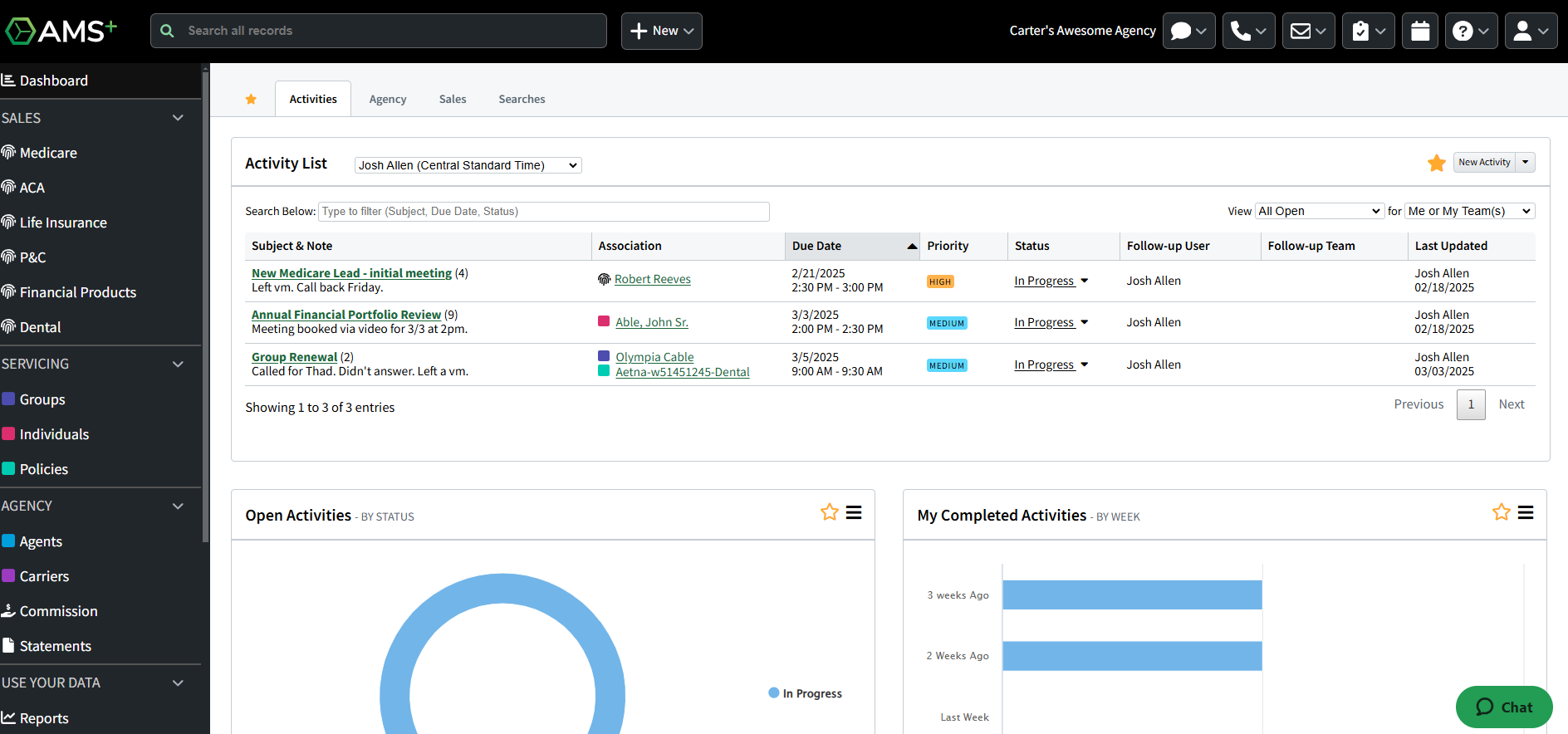

4. AgencyBloc

AgencyBloc is a CRM that’s particular to the life insurance coverage and medical health insurance sectors. It affords insurance coverage advertising automation instruments, prospect and get in touch with administration options, and commissions monitoring. You may as well use AgencyBloc to generate quotes and proposals in addition to handle insurance policies for purchasers. It additionally has coverage renewal automation options.

AgencyBloc has a free trial and affords personalized plans beginning at $75 monthly.

5. AgentCubed

AgentCubed is a buyer relationship administration instrument particular to the insurance coverage {industry}. It has options for coverage administration, automated renewals, advertising and gross sales automation, and extra. AgentCubed allows you to route results in particular brokers or groups, consider gross sales rep efficiency, handle customized proposals, and generate detailed stories.

Contact AgentCubed for a demo and customized pricing.

Jotform: A really perfect CRM resolution for the insurance coverage {industry}

With regards to easy-to-use, intuitive, and versatile CRMs for insurance coverage, Jotform is a superb selection.

This survey maker allows insurance coverage firms to create a CRM primarily based on their distinctive processes and workflows. Simply discover the form templates you need to use to gather lead and buyer information and pair them with a CRM table template to view and handle the incoming data.

Jotform integrates with many enterprise course of instruments — equivalent to challenge administration, cloud storage, and communication options — so you’ll be able to guarantee CRM data flows via completely different components of the group as wanted. Plus, Jotform takes safety severely. Along with our built-in industry-standard safety measures, you may also reap the benefits of our encrypted types characteristic, which supplies you a personal key to your encrypted type information.

Jotform additionally has an ecosystem of enterprise merchandise you should utilize together with your CRM. Attempt Jotform Approvals to automate any trigger-based workflows, equivalent to assigning results in gross sales reps. And if you wish to create visually beautiful stories of your CRM information, then Jotform Report Builder will help you with that.

If you wish to stand out within the bustling insurance coverage {industry}, nurture buyer relationships with ease with Jotform.

Picture by: Thirdman

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)