Custom groups are one in all Sharesight’s most helpful options, however many Sharesight customers are both unaware of them, or they use them minimally (akin to grouping holdings by industries). Used successfully, nonetheless, customized teams can really enable you to make higher funding choices. On this weblog, I’ll clarify what customized teams are, and among the lesser-known customized grouping methods that may enable you to get deeper portfolio efficiency insights and make extra knowledgeable investing choices.

What are customized teams?

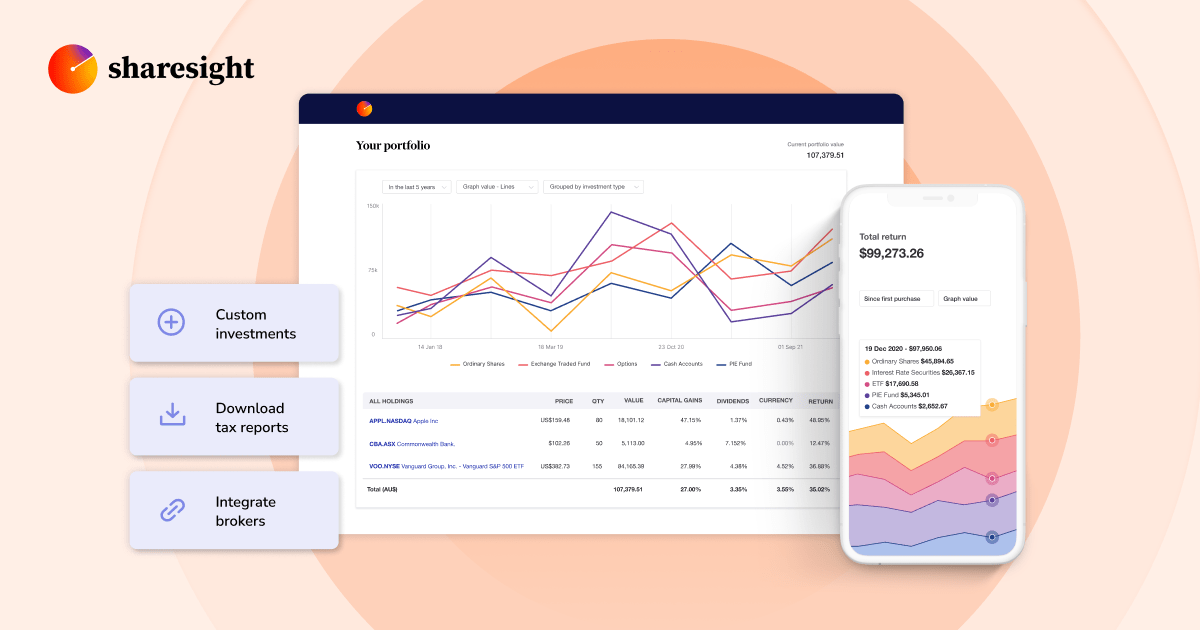

Sharesight’s customized teams function permits you to group your investments into subgroups or classes. Whereas the advantages of grouping rely on why and the way you group your investments, one clear benefit is that it’s a simple technique to cut back psychological load. As an alternative of grouping investments in your head, you outsource this process to Sharesight, which reduces cognitive pressure and frees up your psychological assets to do extra essential evaluation.

With that being stated, listed below are 8 methods you’ll be able to group your holdings:

Asset class

In case you use diversification methods like the normal 60/40 portfolio, the all-weather portfolio (Ray Dalio), the Future Fund mannequin or a world multi-asset technique, grouping your holdings by asset class — akin to home and worldwide equities, crypto, mounted revenue, property and money — is a straightforward technique to monitor your allocation and handle danger. You may see how a lot you maintain in every class by operating the diversity report sorted by customized teams, and use this data to rebalance your portfolio as wanted.

The extent of element in your groupings is completely as much as you. For instance, a 60/40 portfolio solely wants two classes: shares and bonds. However you can too break it down additional: shares into home and worldwide, bonds into authorities and company, and so forth.

Time horizons

I haven’t seen many individuals group their investments by time horizon, nevertheless it could possibly be a strong technique to keep away from thesis drift. You may purchase shares for a spread of causes — some opportunistic, like worth discrepancies or company actions, and others with a mid- to long-term view. Categorising them by intent will help with purchase/promote choices and cut back the danger of letting market costs sway your judgment — for instance, holding short-term trades too lengthy, or promoting robust long-term holdings too quickly.

I made this error myself. I as soon as purchased a inventory for opportunistic causes (low P/E ratio and stable income progress) nevertheless it wasn’t an excellent long-term funding (it was a commoditised enterprise with poor ROE). Because the share worth rose, I held on, influenced by momentum relatively than the unique thesis. I ought to have offered at honest worth. That ended up being a expensive mistake.

Thematic

Grouping your investments by theme might be particularly helpful when you’re targeted on megatrends and long-term progress alternatives. Thematic investments like AI, lithium, cybersecurity and clear vitality gained recognition throughout and after COVID-19 as ETFs made them simpler to entry. In case you maintain a number of ETFs throughout the similar theme, grouping them makes it simpler to trace how every theme contributes to your total efficiency. You may monitor this with the contribution analysis report, assess danger correlations with the drawdown risk report, and establish any overconcentration utilizing the exposure report.

Market capitalisation

For traders with concentrated danger publicity, grouping holdings by market capitalisation — akin to large-cap, mid-cap, small-cap, and micro-cap — creates a structured framework to steadiness danger and return potential. Mega-cap and large-cap shares usually provide stability and decrease volatility, whereas small-cap and micro-cap shares typically current increased progress potential alongside larger danger. Instruments like RoMaD (Return Over Most Drawdown), utilized in our drawdown danger report, will help quantify and evaluate the risk-reward profile of every market cap tier, permitting you to make extra knowledgeable portfolio choices.

Elements

Grouping investments by elements — akin to progress, worth, dividend, or momentum — helps refine your technique and restrict thesis drift. Every class comes with its personal expectations: progress shares have a tendency to hold increased volatility, worth shares typically demand longer time horizons, and momentum trades usually carry out greatest over shorter cycles. Understanding these nuances in occasions of market stress will help you avoid reactive choices, akin to offloading a long-term worth play throughout a dip or holding onto a fading momentum commerce for too lengthy.

Revenue

In case you’re a dividend investor, you may diversify revenue streams throughout REITs, mounted revenue (like authorities or company bonds), and high-yield shares. Grouping these holdings provides you clearer perception into how every class contributes to your portfolio when it comes to money movement timing, diversification, inflation hedging and reinvestment potential. This structured method helps maintain your passive revenue steady and resilient amid altering market situations.

Monetary targets

Grouping investments by monetary targets akin to retirement, schooling, or a house deposit, helps align your portfolio with real-life milestones. Matching belongings to timelines (for instance, shares for long-term progress and money for short-term wants) makes it simpler to trace progress and regulate your technique if returns fall quick. It retains your investments purposeful and reduces the danger of emotional choices.

Valuation

Grouping investments by valuation metrics akin to P/E ratio (worth vs. earnings), ROE (revenue effectivity), SMA200 (long-term pattern), and RSI (overbought/oversold alerts), makes it simpler to identify alternatives and dangers at a look.

Make higher investing choices with Sharesight

Be part of hundreds of traders utilizing Sharesight to remain on high of their investments.

Sign up for a free Sharesight account to trace your returns, handle your tax and uncover portfolio insights, multi functional place.

Source link

![[Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨 [Bombshell News] Consultants say we’re DANGEROUSLY near a recession 🚨](https://i.ytimg.com/vi/DvnKvkjdsMc/maxresdefault.jpg)